On Tuesday, the latest reading of the consumer price index (CPI) showed that inflation rose by 0.5% in January, with the CPI increasing by 6.4% from a year ago.[0] Core CPI, which excludes volatile food and energy prices, was up 0.4% on a monthly basis, faster than the 0.3% monthly increase seen in December.[1] This was slightly higher than economists were expecting and signals that the Federal Reserve is poised to crack down harder by raising its benchmark interest rate more aggressively in the coming months.

Treasury yields rose Tuesday, with the rate on the two-year note climbing as much as 12 basis points to nearly 4.64%, the highest since November and within 20 basis points of last year’s multiyear high.[2] Yields for three- and five-year bonds reached their highest levels in 2023[3]

At the same time, in the markets for commodities, oil prices kept falling as the U.S. dollar strengthened and it was estimated that U.S. inventories had increased.[2] On Wednesday morning, West Texas Intermediate (WTI) crude futures, the U.S. benchmark, dropped by 1%, trading at approximately $78.[2]

Retail sales rose 3.0% M/M in January, significantly higher than the estimated 1.7% increase and following a 1.1% dip in December 2022.[4] This jump in retail sales suggests that consumer spending continues to be strong and could keep prices elevated, which in turn could increase pressure on the Federal Reserve to stick with its rate hikes.[4]

Dow Jones futures dipped 0.2% and S&P 500 futures fell 0.2%, while Nasdaq 100 futures lost 0.2%.[5] The yield on 10-year Treasuries advanced five basis points to 3.79%.[6] For the first time since 2007, the 6-month T-bill rate has surpassed 5%, standing currently at 5.02%.[5]

It is anticipated that the upcoming consumer price index (CPI) that is anticipated to be published Tuesday morning will display that inflation has subsided, thus backing up Federal Reserve Chair Jerome Powell’s conviction that disinflation is occurring.[7] However, some market watchers are worried that high prices could become hard to bring down past a certain level, resulting in an extended period of disinflation.[8]

Though markets have seen a strong recovery since December, due to speculation that the Federal Reserve may end its rate hikes earlier than anticipated, following the downward trend of recent hikes, officials and strategists have cautioned against getting overly optimistic about the situation.[9]

0. “Annual Inflation Cooled Slightly in January as Pace of Moderation Levels Off” The Wall Street Journal, 15 Feb. 2023, https://www.wsj.com/articles/us-inflation-january-2023-consumer-price-index-f080e30b

1. “Annual Services Inflation Rages at New Four-Decade High, Monthly Overall CPI Hottest since June” WOLF STREET, 14 Feb. 2023, https://wolfstreet.com/2023/02/14/annual-services-inflation-rages-at-new-four-decade-high-overall-monthly-cpi-hottest-since-june

2. “Stock market news today: Stocks fall after strong retail sales data” Yahoo News, 15 Feb. 2023, https://news.yahoo.com/stock-market-news-today-february-15-2023-130622082.html

3. “Traders Capitulate, Abandoning Fed Rate Cut Bets After CPI Spike” Yahoo Finance, 14 Feb. 2023, https://finance.yahoo.com/news/traders-capitulate-abandoning-fed-rate-213611625.html

4. “Nasdaq, S&P, Dow mixed as January retail sales jump by the most in almost two years” Seeking Alpha, 15 Feb. 2023, https://seekingalpha.com/news/3936430-nasdaq-sp500-dow-jones-stock-market-retail-sales-data-earnings

5. “Futures Fall After Market Shrugs Off Inflation; Hot Stock Crashes” Investor’s Business Daily, 15 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-market-rally-shrugs-off-hot-inflation-tesla-runs-airbnb-flies-on-earnings

6. “Stocks Fall as Consumer Spending Just Won’t Quit: Markets Wrap” Yahoo Finance, 15 Feb. 2023, https://finance.yahoo.com/news/asia-stocks-set-choppy-open-224521125.html

7. “Consumer prices rose 6.4% in January” Fox Business, 14 Feb. 2023, https://www.foxbusiness.com/economy/will-cpi-reinforce-powells-disinflation-view

8. “Inflation will remain ‘sticky’ for a decade—and Gen Z and millennials are to blame, an investment chief says” Fortune, 14 Feb. 2023, https://fortune.com/2023/02/14/smead-sticky-inflation-decade-millennials-gen-z-spending

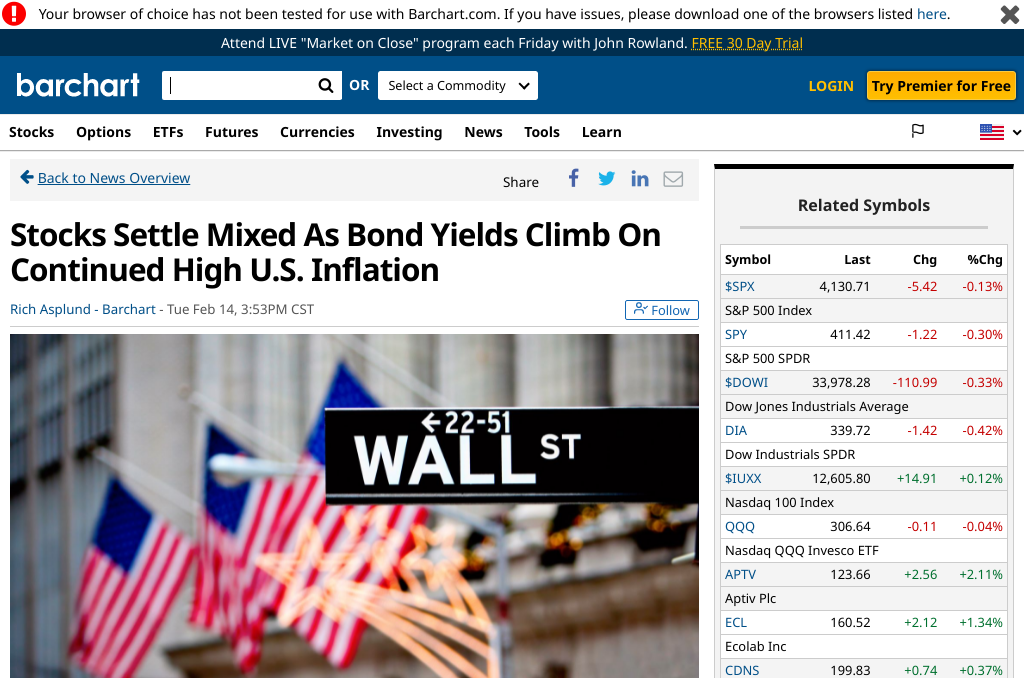

9. “Stocks Settle Mixed as Bond Yields Climb on Continued High U.S. Inflation” Barchart, 14 Feb. 2023, https://www.barchart.com/story/news/14210103/stocks-settle-mixed-as-bond-yields-climb-on-continued-high-u-s-inflation