What is Day Stock Trading?

Day stock trading is a type of trading that involves buying and selling securities within a day to profit from price movements. As the name implies, day trading must be completed within a single trading day, meaning all positions must be closed before the market closes for the day. Day trading has become increasingly popular, thanks to trading apps and 0% commissions, which have made it easier for retail investors to try trading like professionals.

To be a successful day trader, you must have knowledge and experience in the marketplace, sufficient capital, and an edge over the rest of the market. However, despite its popularity, the profit potential of day trading is debated, and many professional money managers and financial advisors shy away from it.

In this article, we will explore the intricacies of day stock trading, the risks involved, and how to succeed in this type of trading. We’ll also look at alternatives to day trading and the best platforms for day trading.

What is Day Stock Trading?

Definition of Day Stock Trading

Day stock trading, as defined by Investopedia, is the act of buying and selling securities within a single trading day to profit from price movements. Day traders aim to make a profit by buying at a lower price and selling at a higher price or by selling at a higher price and buying back at a lower price.

How Day Traders Profit from Price Movements

Day traders aim to make money by taking advantage of small price movements in highly liquid stocks. They rely on market volatility, which is the tendency of the market to fluctuate rapidly over short periods, to change their position without altering the stock’s price.

How Trading Apps Have Made It Easier for Retail Investors

Thanks to trading apps, it has become easier for retail investors to try day stock trading. Trading apps offer a user-friendly interface and convenient access to markets, allowing investors to trade from their mobile devices. Moreover, many trading apps offer zero-commission trading, which means investors can trade securities without paying a commission. Investopedia provides more information on how trading apps have made day stock trading more accessible.

Debates on the Profit Potential of Day Trading

The profit potential of day trading is debated, and many professional money managers and financial advisors shy away from it. While some day traders have made substantial profits, others have lost significant amounts of money. The high risk and volatility associated with day trading make it a challenging and often stressful endeavor. Investopedia provides more information on the profit potential of day trading.

Intricacies of Day Stock Trading

Various Intraday Strategies

There are various intraday strategies that day traders use to make a profit. These strategies include:

- Scalping: Scalping is a strategy that involves making small profits from small price movements in highly liquid stocks. Day traders who use this strategy typically hold their positions for a few seconds or minutes.

- Range Trading: Range trading is a strategy that involves buying at the lower end of a stock’s price range and selling at the upper end of the range. Day traders who use this strategy typically hold their positions for a few minutes or hours.

- News-Based Trading: News-based trading is a strategy that involves trading stocks based on news events. Day traders who use this strategy typically monitor news sources and trade stocks that are likely to be affected by the news.

- High-Frequency Trading: High-frequency trading is a strategy that involves using sophisticated algorithms to trade stocks at high speeds. Day traders who use this strategy typically hold their positions for a few seconds or less.

Importance of Market Volatility and Highly Liquid Stocks

Day traders rely on market volatility and highly liquid stocks to change their position without altering the stock’s price. Market volatility refers to the tendency of the market to fluctuate rapidly over short periods. Highly liquid stocks are stocks that are easily bought and sold without significantly affecting their price.

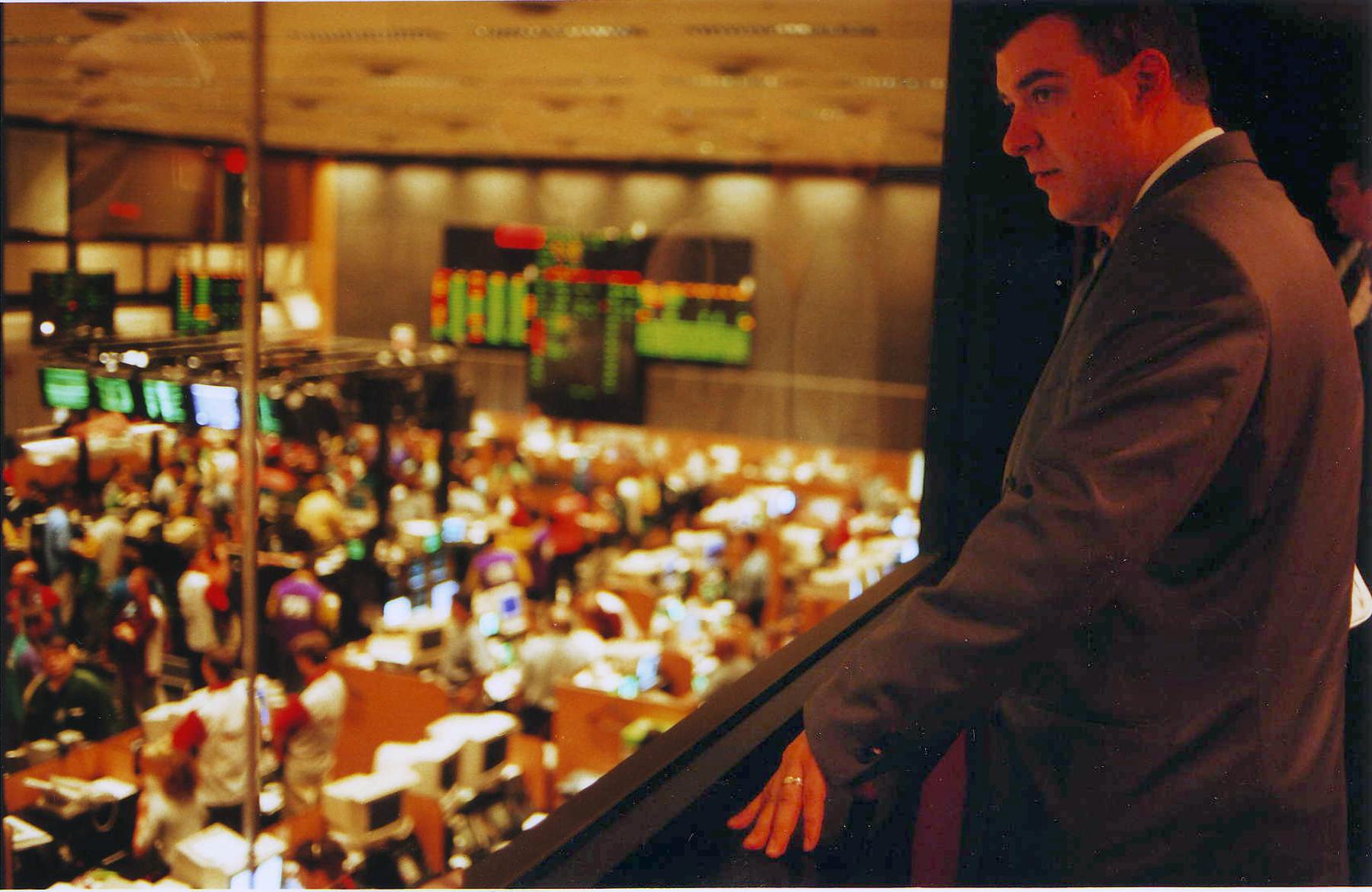

How Institutional Traders Have an Advantage over Solo Traders

Institutional traders have an advantage over solo traders due to their access to resources such as direct lines to counterparties, a trading desk, and expensive analytical software. Solo traders typically day trade using technical analysis and swing trades, combined with leverage.

In the next section, we will explore the risks associated with day stock trading and why many professional money managers and financial advisors shy away from it.

Risks Associated with Day Stock Trading

Day trading is a risky career choice and requires knowledge, resources, and cash to have a chance at success. In this section, we will explore the risks associated with day stock trading and why many professional money managers and financial advisors shy away from it.

Lack of Discipline and Criteria

Day traders often lose money due to the lack of discipline in sticking to their own criteria. Successful day traders have a well-defined trading plan and stick to it religiously. Day traders who do not have a trading plan or deviate from their plan often lose money.

Leveraging and Risk

Day traders often use leveraged investment strategies, such as options trading and margin trading, which compound risk. Leveraging is the practice of borrowing money to invest in securities. While leveraging can increase profits, it can also increase losses.

SEC’s Warning on Day Trading

The Securities and Exchange Commission’s director of the Office of Investor Education and Advocacy, Lori Schock, has warned investors that day trading is a risky business and that those engaging in the speculative investment activity should be aware of the considerable dangers. Day trading involves buying and selling securities on the same day to profit from market, and stock price changes, and often involves borrowing or leveraging active capital to purchase additional assets, thereby increasing risk.

Long-Term Investing Strategies

Schock recommends investors consider long-term investing strategies that diversify investments across a mix of stock, bonds, and cash to reduce risk and volatility. Investing for the long-term allows investors to ride out market volatility and benefit from the long-term trend of the market.

In the next section, we will explore the skills and resources required to be a successful day trader.

For Successful Day Stock Trading, Use Resources and Skills

One needs knowledge and experience in the market, sufficient capital, and an edge over the rest of the market in order to be a successful day trader. The abilities and resources required to be a successful day trader will be discussed in this section.

Knowledge and Experience in the Market

A thorough understanding of the market and the securities traded is necessary for day trading. Successful day traders lay a solid foundation in market psychology, technical analysis, and securities analysis.

Sufficient Capital is Important.

To take advantage of opportunities and cover losses, day trading needs sufficient capital. Since day traders frequently trade with a lot of leverage, they borrow money to invest in securities. While leveraging can boost earnings, losses can also rise.

An Edge over the Rest of the Market

Successful day trading requires an edge over the rest of the market. Access to information, cutting-edge analytical tools, or expertise in a particular industry can all contribute to this advantage.

Dedication and Discipline

Dedication and discipline are essential for day trading. Successful day traders have a well-defined trading strategy and follow it religiously. Additionally, they have the authority to carry out their plan and avoid deviating from it.

Strict Money Management Control

To control risk and prevent losses, day traders must have strict money management controls in place. This entails establishing stop-loss orders, limiting the amount of capital at risk on any one trade, and having a daily loss cap.

The typical day trading strategies employed by day traders will be discussed in the next section.

Common Day Trading Strategies

To profit, day traders employ a range of tactics. In this section, we’ll look at some of the most popular day trading strategies used by traders.

The Trend That Follows Trend

A strategy known as trend following entails determining the market’s direction and purchasing or selling securities in accordance with that direction. The majority of day traders who employ this strategy hold their positions for a few minutes or hours.

Range Trading: ### Range Trading

A strategy known as range trading entails purchasing at the lower end of a stock’s price range and selling at the upper end of the range. The majority of day traders who employ this strategy hold their positions for a few minutes or hours.

Reversals

Reversals are a strategy that entails spotting a trend and purchasing or selling securities when the trend reverses. The majority of day traders who employ this strategy hold their positions for a few minutes or hours.

breakouts: ### Breakouts

Breakouts are a strategy that entails determining a level of support or resistance and purchasing or selling securities when the price breaks through that level. The majority of day traders who employ this strategy hold their positions for a few minutes or hours.

Scalping is a form of retaliation.

Small profits from small price changes in highly liquid stocks are the goal of the scalping strategy. The majority of day traders who employ this strategy hold their positions for a few seconds or minutes.

News-Based Trading: News

Trading stocks based on current events is a strategy known as news-based trading. Trading stocks that are likely to be impacted by the news is typically done by day traders using this strategy.

We will look at some of the top online brokers and platforms for day trading in the next section.

Best Online Brokers and Platforms for Day Stock Trading

Choosing the right online broker or platform is crucial for day stock trading. In this section, we will explore some of the best online brokers and platforms for day stock trading.

Robinhood

Robinhood is a popular trading app that offers commission-free trading for stocks, options, and ETFs. The platform is user-friendly and offers real-time market data and news. Robinhood also offers margin trading and cryptocurrency trading.

TD Ameritrade

TD Ameritrade is a popular online broker that offers a wide range of trading tools and resources. The platform offers commission-free trading for stocks, ETFs, and options. TD Ameritrade also offers advanced charting and technical analysis tools.

E*TRADE

E*TRADE is an online broker that offers commission-free trading for stocks, ETFs, and options. The platform offers advanced charting and technical analysis tools, as well as real-time market data and news.

Charles Schwab

Charles Schwab is an online broker that offers commission-free trading for stocks, ETFs, and options. The platform offers advanced charting and technical analysis tools, as well as real-time market data and news. Charles Schwab also offers a wide range of educational resources and trading tools.

Interactive Brokers

Interactive Brokers is an online broker that offers commission-free trading for stocks, ETFs, and options. The platform offers advanced charting and technical analysis tools, as well as real-time market data and news. Interactive Brokers also offers advanced trading tools for professional traders.

In the next section, we will summarize the key takeaways from this article.

Key Takeaways

In this article, we explored the world of day stock trading. Here are some key takeaways to keep in mind:

- Day trading involves buying and selling securities within a day to profit from price movements.

- Day traders use various intraday strategies such as scalping, range trading, news-based trading, and high-frequency trading.

- To be a successful day trader, one needs knowledge and experience in the marketplace, sufficient capital, and an edge over the rest of the market.

- Day trading requires dedication, discipline, and strict money management controls.

- Choosing the right online broker or platform is crucial for day stock trading.

Remember, day stock trading is a risky career choice and requires knowledge, resources, and cash to have a chance at success. It’s important to have a well-defined trading plan and stick to it religiously. And always remember to do your research before investing.

Thank you for reading! Check out our other great content for more insights on investing and personal finance.

Questions

Question: Who can participate in day stock trading?

Answer: Anyone with knowledge, resources, and capital can participate in day stock trading.

Question: What are the most common day trading strategies?

Answer: The most common day trading strategies are trend following, range trading, and news-based trading.

Question: How much money do I need to start day stock trading?

Answer: You need sufficient capital to cover your trading expenses and to meet the minimum margin requirements.

Question: What are the risks of day stock trading?

Answer: The risks of day stock trading include market volatility, lack of discipline, and the potential for significant losses.

Question: How do I choose the right online broker for day stock trading?

Answer: Choose a broker that offers commission-free trading, real-time market data, and advanced charting and technical analysis tools.

Question: What if I’m not successful at day stock trading?

Answer: Day stock trading is a risky career choice. If you’re not successful, consider alternative investment strategies such as long-term investing or diversification.