The Dow Jones Industrial Average rose 1.05% on Thursday and the S&P 500 index rallied 0.8%. The Nasdaq composite advanced 0.7%, while the small-cap Russell 2000 climbed 0.2%.

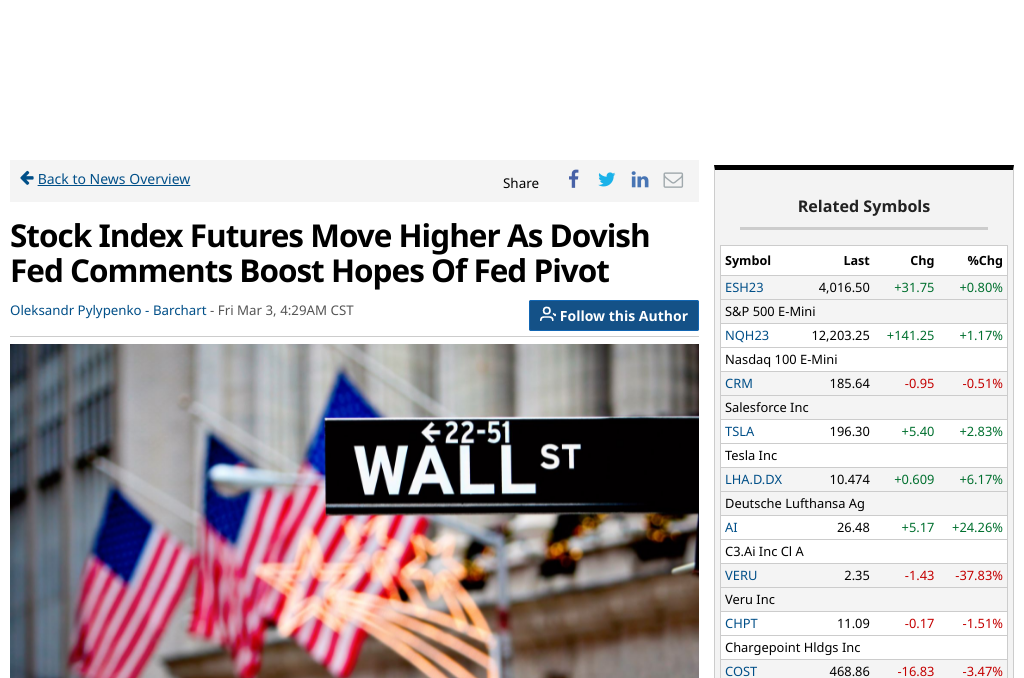

On Thursday, the Dow Jones gained nearly 1.1%, the S&P 500 rose 0.8%, and the Nasdaq advanced 0.7%.[0] The small-cap Russell 2000 followed up with a 0.2% gain. After Friday’s market open, the Dow was up 0.3% and the S&P 500 moved up 0.7%. The Nasdaq composite, which is heavily driven by technological stocks, rose 1.1%, while Marvell Technologies (MRVL) dropped by over 9% due to its weak first-quarter earnings forecast.[0]

Atlanta Fed President Raphael Bostic said he favors “steady” quarter-point rate increases to limit risk to the economy as the impact of higher interest rates may only begin to “bite” in the spring.[1] Bostic indicated that the Fed may have the capacity to halt rate rises by mid- or late-summer. He simultaneously cautioned that if inflation data proved to be higher than anticipated, it could alter Fed policy.[1] Also, Fed Governor Christopher Waller said a string of “hot” data might force the U.S. central bank “to raise interest rates even more”, citing January’s red-hot payrolls report.[1]

Sentiment improved after Atlanta Fed’s Raphael Bostic said that the central bank could possibly pause its rate hikes sometime this summer. Despite the assertion by Bostic and other Federal Reserve officials that they will remain data-dependent, investors interpreted his remarks as being dovish.[2] Priya Misra, global head of rates strategy at TD Securities, noted that traders are feeling optimistic, as even the most hawkish Federal Reserve officials have not suggested that interest rates could rise higher than current expectations.[2] In the swap markets, the expected peak rate of Federal Reserve policy is predicted to be 5.5% in September.[2]

The possibility that the Federal Reserve may increase rates for an extended period of time caused alarm.[3] Stocks managed to make a comeback following news that the Federal Reserve Bank of Atlanta’s President Raphael Bostic, who does not have a vote in the central bank, said that there is the potential for the Fed to end their tightening cycle by mid- to late summer.[4]

0. “Dow Jones Rises Amid Key Economic Data; AI Stock Soars On ‘Dramatic Change’ In Sentiment” Investor’s Business Daily, 3 Mar. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-rise-ahead-of-economic-data-ai-stock-soars-on-dramatic-change-in-sentiment/

1. “Stock Index Futures Move Higher As Dovish Fed Comments Boost Hopes Of Fed Pivot” Barchart, 3 Mar. 2023, https://www.barchart.com/story/news/14739365/stock-index-futures-move-higher-as-dovish-fed-comments-boost-hopes-of-fed-pivot

2. “US Stocks Rise as Sentiment Improves; Bonds Rally: Markets Wrap” Yahoo News, 3 Mar. 2023, https://news.yahoo.com/asia-stocks-set-rise-wall-225254432.html

3. “Stock market news today: Fears of high interest rates hit investors” Markets Insider, 1 Mar. 2023, https://markets.businessinsider.com/news/stocks/stock-market-news-today-investors-fear-high-interest-rates-fed-2023-3

4. “Dow Jones Rallies As Tesla Dives, Leads ‘Race To The Bottom’; Warren Buffett Stock Craters” Investor’s Business Daily, 2 Mar. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-gains-tesla-stock-dives-leads-race-to-the-bottom-warren-buffett-stock-craters-elon-musk