Federal Reserve Chairman Jerome Powell spoke Tuesday at the Economic Club of Washington, D.C. He discussed the central bank’s latest interest-rate increase and said more increases will likely be needed as the Fed continues its push to restrain inflation.[0] Powell also said that the U.S. labor market remains “extraordinarily strong” and that Friday’s monster jobs report underscored that the central bank has more work to do to bring down inflation.[1]

The Fed raised its benchmark interest rate a quarter percentage point, the eighth increase since March 2022, to a target range of 4.5%-4.75%.[2] Powell said that although the process of getting inflation down has started, it “has a long way to go” and that these are “the very early stages”.[3] He added that the Fed expects “significant” declines in inflation this year and that it will take “not just this year but next year to get down to 2%,” the central bank’s inflation target.[4] He also noted that rates will have to remain at a restrictive level “for a period of time” before that happens.[3]

Powell’s speech was eagerly awaited by traders as an opportunity for the head of the central bank to clarify where rates are headed, and for how long, and to detail comments interpreted as dovish that were made after last week’s quarter-point increase in fed funds.[5] Minneapolis Fed President Neel Kashkari also commented on the strong labor-market report, saying that the Fed needs to keep raising interest rates and that “right now he’s still around 5.4%,” referring to his forecast for how high interest rates need to go to curb inflation.[6]

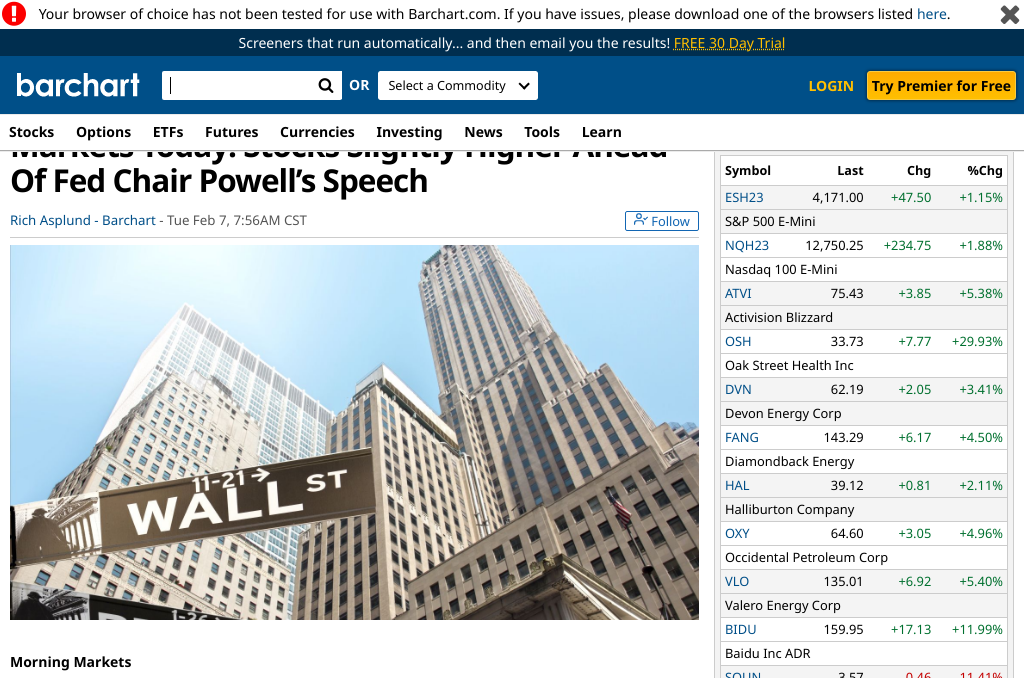

The markets were also reacting to other news on Tuesday.[1] Chinese search engine Baidu (BIDU) jumped 12% after indicating it’s on track to unveil its ChatGT-like AI service in March.[7] Meanwhile, Activision Blizzard (ATVI) rose over 5% after earnings and Oak Street Health (OSH) surged more than +30% in pre-market trading on news that CVS Health Corp.[6] CVS is close to completing an agreement to acquire the prior entity for approximately $10.5 billion.[8]

On the other hand, Pinterest’s (PINS) stock fell 3.4% after the platform reported quarterly revenue late Monday that missed Wall Street estimates, renewing concerns about weakness in the ad market.[6]

0. “Powell Says Further Rate Hikes Needed Amid ‘Strong’ Labor Market” Bloomberg, 7 Feb. 2023, https://www.bloomberg.com/news/articles/2023-02-07/powell-says-further-rate-hikes-needed-amid-strong-labor-market

1. “Fed Chair Powell: Inflation fight will take ‘a significant period of time’” Channel3000.com – WISC-TV3, 7 Feb. 2023, https://www.channel3000.com/news/money/fed-chair-powell-inflation-fight-will-take-a-significant-period-of-time/article_211c5f36-b41b-596b-ac13-2236c9762316.html

2. “Fed’s Powell speaks on economy, job market” The Washington Post, 7 Feb. 2023, https://www.washingtonpost.com/business/2023/02/07/powell-economy-jobs/

3. “Fed Chair Powell: Inflation fight will take ‘a significant period of time’” CNN, 7 Feb. 2023, https://www.cnn.com/2023/02/07/economy/jerome-powell-economic-club-speech/index.html

4. “Americans will see ‘significant decline in inflation’ in 2023: Powell” Business Insider, 7 Feb. 2023, https://www.businessinsider.com/when-will-inflation-go-down-significant-decline-this-year-powell-2023-2

5. “Stock Market News Today: Indices Turn Volatile after Powell Speech” TipRanks, 7 Feb. 2023, https://www.tipranks.com/news/stock-market-news-today-futures-up-ahead-of-powell-speech

6. “Markets Today: Stocks Slightly Higher Ahead of Fed Chair Powell’s Speech” Barchart, 7 Feb. 2023, https://www.barchart.com/story/news/13975845/markets-today-stocks-slightly-higher-ahead-of-fed-chair-powells-speech

7. “Stock market news live updates: Stocks swing as investors mull Powell remarks” Yahoo News, 7 Feb. 2023, https://news.yahoo.com/stock-market-news-live-updates-february-7-2023-120657185.html

8. “US Stocks Pause As Traders Await Powell’s Speech: Analyst Warns Of Retest Of October Lows As Market, Econ” Benzinga, 7 Feb. 2023, https://www.benzinga.com/news/earnings/23/02/30756924/us-stocks-pause-ahead-of-powells-speech-analyst-warns-of-retest-of-october-lows-as-market-economic–