The first quarter earnings season has officially started, with notable names such as JPMorgan Chase, Wells Fargo, BlackRock, Citigroup, and PNC Financial Services all reporting their latest financial results.[0] Investors are watching for clues about stability, as the estimated 6.8% decline in first-quarter earnings is not just the lowest in two years, but also below the five-year earnings growth rate of 13.4% and the 10-year earnings growth rate of 8.7%. Credit quality trends at banks will also be scrutinized, not only as a measure of bank health but to get a read on the outlook for the economy.

However, the turmoil didn’t seem to impact JPMorgan, which saw first-quarter earnings surge 56% year-over-year to $4.10 per share, and revenue jump 25% to a record $38.4 billion.[1] On its end, Citigroup announced consistent growth in both its revenue and profit for the quarter due to an increase in interest rates that led to a significant 18% rise in revenue from personal banking compared to the previous year.[1] The market liked JPMorgan’s raised guidance for net interest income this year, though management has stated that 2023 will mark the high watermark on this count over the next few years.[2]

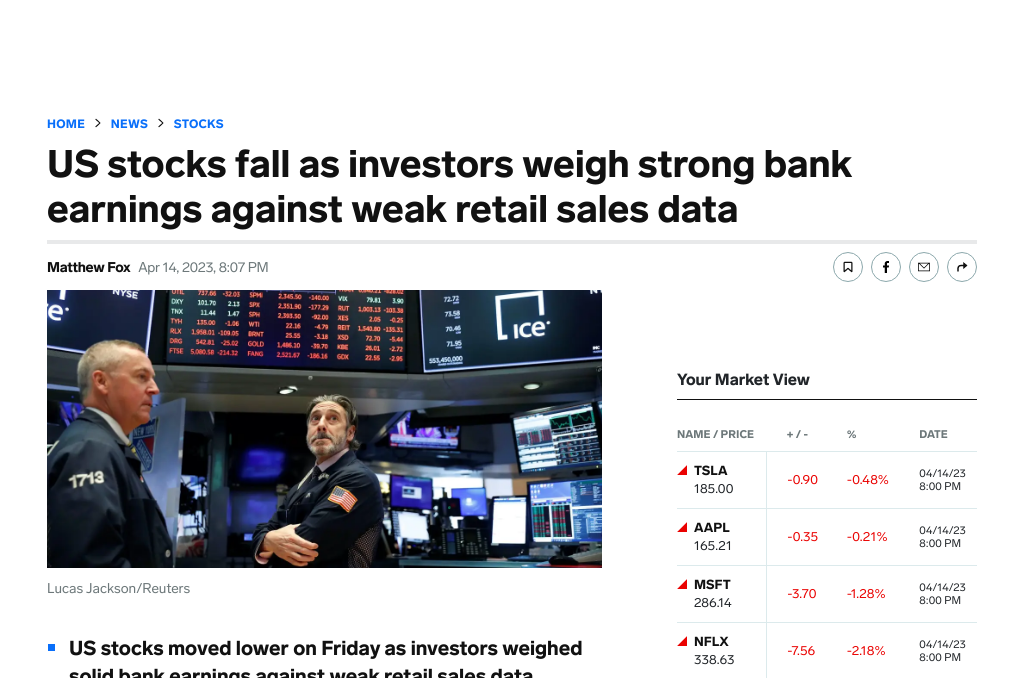

Banks can benefit from higher interest rates as they can charge more for loans, which could increase their revenue.[3] In January, JPMorgan projected a rise of 11% in its net interest income to reach $74 billion this year.[3] The CEO of the company, Jamie Dimon, stated in the earnings report that the American economy remains mostly robust, with strong consumer spending and healthy business performance. Nonetheless, the potential risks that have been observed over the past year still loom, and the turmoil in the banking industry only exacerbates these concerns.[4]

The big U.S. bank earnings reports will be studied even more carefully than before, with investors focusing on what the bankers say about the economic outlook, consumer credit quality, and business activity. The estimated 6.8% decline in first-quarter earnings is not just the lowest in two years, but also below the five-year earnings growth rate of 13.4% and the 10-year earnings growth rate of 8.7%. Credit quality trends at banks will also be scrutinized, not only as a measure of bank health but to get a read on the outlook for the economy.

The earnings season will continue next week, with Bank of America and Goldman Sachs reporting on Tuesday, followed by Morgan Stanley and U.S. Bancorp on Wednesday. Regional banks, including Citizens Financial Group and First Republic Bank, are also due to begin reporting next week.[5]

Overall, the first quarter earnings season is being watched closely by investors, as it will provide a glimpse into the health of the economy and the banking industry. With the estimated decline in earnings, there is added pressure for companies to perform well and provide positive outlooks for the future.

0. “Investors are watching guidance this earnings season, but might not like what they see” CNN, 12 Apr. 2023, https://www.cnn.com/2023/04/12/business/q1-earnings/index.html

1. “Stock Market Today: Big Bank Earnings Fail to Lift Stocks” Kiplinger’s Personal Finance, 14 Apr. 2023, https://www.kiplinger.com/investing/stocks/stock-market-today-big-bank-earnings-fail-to-lift-stocks

2. “Analyzing Q1 Bank Earnings: Good or Bad?” Yahoo Finance, 14 Apr. 2023, https://finance.yahoo.com/news/analyzing-q1-bank-earnings-good-221610442.html

3. “America’s largest banks prepare to show investors why they’re not like SVB” Yahoo Finance, 13 Apr. 2023, https://finance.yahoo.com/news/americas-largest-banks-prepare-to-show-investors-why-theyre-not-like-svb-133532139.html

4. “Stock market news today: Retail sales weigh on solid bank earnings” Markets Insider, 14 Apr. 2023, https://markets.businessinsider.com/news/stocks/stock-market-news-today-retail-sales-data-solid-bank-earnings-2023-4

5. “5 Things for All Investors to Watch in Q1 Bank Earnings” Morningstar, 12 Apr. 2023, https://www.morningstar.com/articles/1149482/5-things-for-all-investors-to-watch-in-q1-bank-earnings