The markets were mixed on Thursday as investors monitored a slew of economic data and the Federal Reserve’s comments on inflation. Shares of Cisco Systems (CSCO) were up 5.2%, leading the Dow Jones Industrial Average, as the company reported better-than-expected quarterly results, boosted its dividend, and raised its fiscal 2023 outlook.[0] Shares of Roku (ROKU) also rose 10% in pre-market trading after the company reported upbeat fourth-quarter results and posted a better-than-expected forecast for the current quarter.[1]

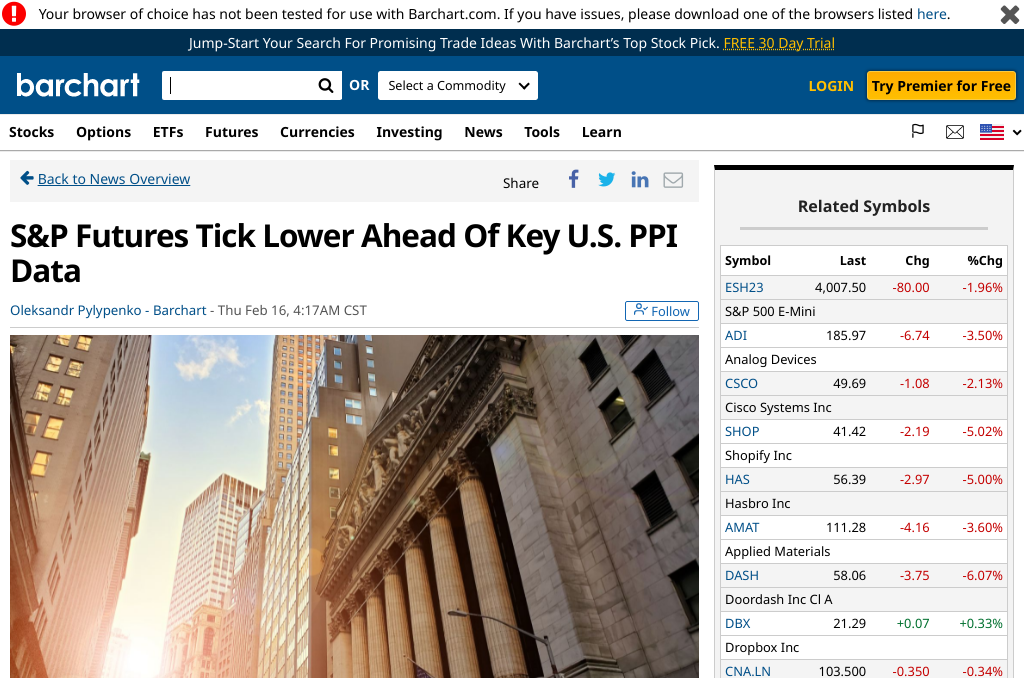

The Nasdaq Composite (COMP.IND) fell 1.6%, the benchmark S&P 500 (SP500) declined by 1.3%, and the Dow (DJI) slid 1.4%. The S&P 500 experienced a decrease of 1.8%, the Dow Jones Industrial Average dropped by 1.9%, amounting to 638 points, and the Nasdaq Composite declined by 2.2%.

The yield on the benchmark 10-year Treasury note inched up 1 basis point to 3.87%. West Texas Intermediate crude oil prices dropped by almost 1%, trading at approximately $78 per barrel.[2] Thursday morning saw the yield on the benchmark 10-year U.S. Treasury note dip to 3.78%. The dollar index declined by almost 0.3%, now trading at $103.65.[3]

Retail sales surged 3% in January, the Commerce Department said, reversing two consecutive monthly declines, coupled with higher-than-expected reading on consumer prices Tuesday, leaving unsettled investors concerned that the central bank could keep raising interest rates.[1]

It is currently anticipated that the central bank will raise interest rates by a quarter-point at each of their upcoming three meetings, with the first of these being held in late March.[4] This week, several speakers from the Federal Reserve have advocated for more forceful rate increases to control inflation.[4] The minutes from the Federal Open Market Committee’s meeting will be made available on Wednesday, and the Core Personal Consumption Expenditures (PCE) index, which is the Fed’s preferred measure of inflation, will be published on Thursday, along with 4th quarter U.S. Gross Domestic Product[5]

Meanwhile, bitcoin (BTC-USD) has rallied by 8.5% in the last 24 hours to US$24,065.86.[6] In the last day, Bitcoin (BTC-USD) has increased significantly, achieving a peak not seen in the last six months, while some apprehension lingers due to regulatory actions.[3]

0. “Markets Nosedive on Another Surprising Inflation Report” Investopedia, 16 Feb. 2023, https://www.investopedia.com/markets-nosedive-on-another-surprising-inflation-report-7110856

1. “S&P Futures Tick Lower Ahead of Key U.S. PPI Data” Barchart, 16 Feb. 2023, https://www.barchart.com/story/news/14260125/s-p-futures-tick-lower-ahead-of-key-u-s-ppi-data

2. “Dow Jones Dives Amid Inflation Data Surprise; Elon Musk Offers This Defense Amid Big Tesla Recall” Investor’s Business Daily, 16 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-falls-amid-inflation-data-surprise-elon-musk-lashes-out-amid-big-tesla-recall-tesla-stock-tsla-stock-microsoft-stock-ai-chatgpt/

3. “Stock market news today: Stocks sell off after hot inflation report, hawkish Fedspeak” Yahoo News, 16 Feb. 2023, https://news.yahoo.com/stock-market-news-live-updates-february-16-2023-122740853.html

4. “Stock Market Today: Stocks Close Mostly Lower Amid Rate-Hike Worries” Kiplinger’s Personal Finance, 17 Feb. 2023, https://www.kiplinger.com/investing/stocks/stock-market-today-021723-stocks-close-lower-amid-rate-hike-worries

5. “US Dollar Holds Gains as Markets Weigh Fed Moves. Will Yields Boost USD?” DailyFX, 20 Feb. 2023, https://www.dailyfx.com/news/us-dollar-holds-gains-as-markets-weigh-fed-moves-will-yields-boost-usd-20230220.html

6. “Market Highlights: Big rally in US travel stocks, Bitcoin; and 5 ASX small caps to watch on Thursday” Stockhead, 15 Feb. 2023, https://stockhead.com.au/news/market-highlights-big-rally-in-us-travel-stocks-bitcoin-and-5-asx-small-caps-to-watch-on-thursday/