Federal Reserve Chair Jerome Powell testified before the House Financial Services Committee and Senate Banking, Housing and Urban Affairs Committee on Tuesday and Wednesday to deliver his semi-annual monetary policy report to Congress.[0] Powell warned that if the totality of the data indicates that faster tightening is warranted, the Fed would be prepared to increase the pace of rate hikes. This suggests that the ultimate level of interest rates is likely to be higher than previously anticipated, which could have significant implications for the U.S. economy and markets.

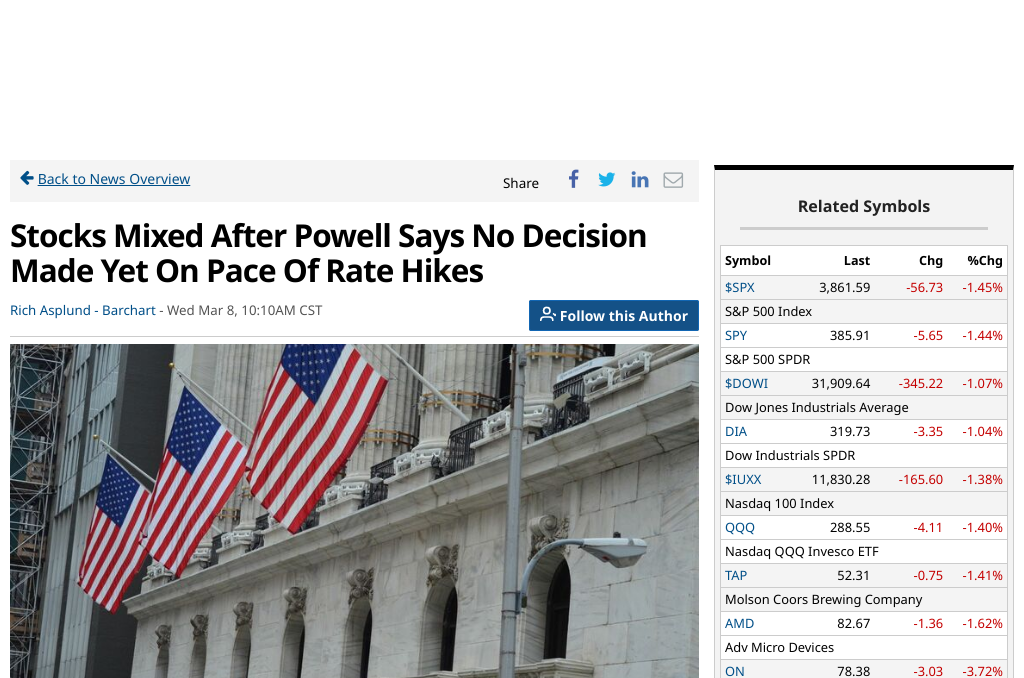

Powell acknowledged that roughly 2 million Americans could lose their jobs this year due to the central bank’s efforts to slow the economy, noting that “Will working people be better off if we just walk away from our jobs and inflation remains 5-6%?”[1] Markets responded to the Fed’s hawkish stance, with the Dow Jones Industrial Average falling 575 points, or 1.7%, and the S&P 500 and Nasdaq each dropping more than 1%.[2]

Investors had expected the Fed to raise rates by 0.25 percentage points at its meeting later this month.[3] The likelihood of a bigger, 0.5 point rise in rates increased significantly following Powell’s statement.[4] On Tuesday morning, investors were estimating that there was a 30% chance that the interest rate would be increased by half a point before the end of the month.[4] By the end of trading, the likelihood had increased to 70%, as reported by the CME FedWatch Tool.[4]

The stronger dollar and weak China imports weighed on crude oil prices, with U.S. crude falling 3.6% to $77.58 a barrel.[5] The price of copper decreased by 2.8%, due to similar causes.[5] Precious metals prices recovered from early losses and are moderately higher, with April gold up 0.38% and May silver up 0.40%.[6]

Powell also warned lawmakers that Congress must raise the debt ceiling, noting that the Fed doesn’t have the tools to prevent or mitigate the economic catastrophe resulting from an unprecedented U.S. debt default.[1] He stated that “Congress really needs to raise the debt ceiling. That’s the only way out.”

It is clear that the Fed’s actions have the potential to spark a recession and a rise in unemployment, with investors weighing the potential costs and benefits of higher rates.[7] Powell is right in pointing out that Congress must raise the debt ceiling for the economy to avoid disaster.

0. “Jay Powell has another problem now: Morning Brief” Yahoo News, 10 Mar. 2023, https://news.yahoo.com/jay-powell-now-has-another-problem-morning-brief-103100176.html

1. “Five takeaways from Powell’s House testimony” The Hill, 8 Mar. 2023, https://thehill.com/business/3890199-five-takeaways-from-powells-house-testimony/

2. “Full Steam Ahead for Jerome Powell – WSJ” The Wall Street Journal, 7 Mar. 2023, https://www.wsj.com/articles/jerome-powell-capitol-hill-federal-reserve-inflation-markets-5da4d66

3. “Federal Reserve Chair Jerome Powell warns inflation fight will be long and bumpy” NPR, 7 Mar. 2023, https://www.npr.org/2023/03/07/1161623217/federal-reserve-jerome-powell-senate-inflation-interest-rates-economy-recession

4. “Jerome Powell’s testimony sent markets reeling. That may be a good thing” CNN, 8 Mar. 2023, https://www.cnn.com/2023/03/08/investing/premarket-stocks-trading/index.html

5. “Dow Jones Futures RiseAfter ‘Faster’ Fed Chief Powell Hits Stocks; Tesla Falls On New Probe” Investor’s Business Daily, 8 Mar. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-faster-fed-chief-powell-hits-stocks-tesla-falls-below-key-level/

6. “Stocks Mixed After Powell Says No Decision Made Yet on Pace of Rate Hikes” Barchart, 8 Mar. 2023, https://www.barchart.com/story/news/14888162/stocks-mixed-after-powell-says-no-decision-made-yet-on-pace-of-rate-hikes

7. “US debt default could cause ‘longstanding harm,’ Fed Chair Jerome Powell says” ABC News, 7 Mar. 2023, https://abcnews.go.com/Politics/us-debt-default-cause-longstanding-harm-fed-chair/story?id=97665681