The U.S. labor market continued to show strength in March as nonfarm payrolls rose by 236,000, slightly below expectations of 240,000. The unemployment rate also ticked down to 3.5% from 3.6% in February, indicating a tight labor market.[0] However, the numbers were not strong enough to ease expectations of at least one more rate hike by the Federal Reserve.

The report had an impact on Treasury yields, as the 10-year yield hit a seven-month low on Thursday before jumping on Friday following the jobs report. On Monday, the 10-year yield traded at 3.38%, up slightly from last week’s low.[1]

Tesla was one of the stocks hit by the report, falling over 4% in morning trading after cutting prices for all of its vehicles in the U.S. for the second time this year. However, Pioneer Natural Resources soared after a report hinted that Exxon Mobil held talks with the shale driller about a possible acquisition.[2]

Meanwhile, Alphabet CEO Sundar Pichai announced that the tech firm would incorporate chat artificial intelligence (AI) in its Google search engine, causing shares to advance.[3] Apple, on the other hand, saw its shares fall over 2% after a report showed its Q1 PC shipments fell by 40.5% year-over-year.[2]

In economic news, wholesale inventories grew by just 0.1% in February, below estimates of 0.2%, while sales rose 0.4%, lower than the expected 0.6% gain.[4] The United States Census Bureau also reported that job openings fell to their lowest level since May 2021, suggesting that the labor market may have begun to weaken.[5]

The Institute for Supply Management (ISM) also reported that its services sector index, which measures business activity across several industries, fell to 51.2% in March from February’s 55.1%.[6] Although the services sector is still expanding, as indicated by readings above 50%, the rate of growth has decelerated beyond the projected level.[7]

Federal Reserve Bank of Cleveland President Loretta Mester added to the discussion by stating that the central bank will need to raise rates further to tame inflation.[6]

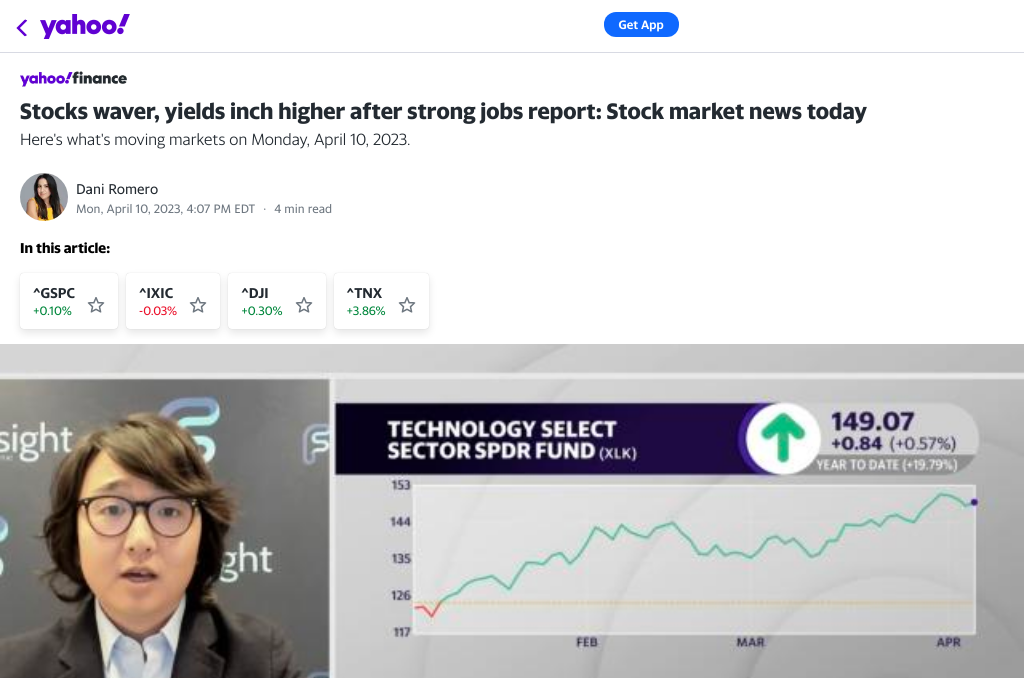

Overall, the market remained volatile with the S&P 500 slipping nearly 0.6%, the Dow Jones Industrial Average down 0.

0. “Nasdaq, S&P, Dow waver as traders bake in one more Fed hike after Friday’s jobs data” Seeking Alpha, 10 Apr. 2023, https://seekingalpha.com/news/3955341-nasdaq-sp-dow-waver-as-traders-bake-in-one-more-fed-hike-after-fridays-jobs-data

1. “US Stocks Stumble, Treasuries And Gold Rally On Rising Recession Fears – Traders Anticipate Fed Pause In May …” Benzinga, 4 Apr. 2023, https://www.benzinga.com/news/earnings/23/04/31650748/us-stocks-set-to-open-higher-today-on-strong-momentum-analyst-says-next-fed-rate-decision-could-be–

2. “Stocks fall, yields inch higher after strong jobs report: Stock market news today” Yahoo Finance, 10 Apr. 2023, https://finance.yahoo.com/news/stock-market-news-today-live-updates-april-10-2023-121105758.html

3. “Dow Jones Futures: Market Rally Responds To Jobs Report, Tesla Price Cuts | Investor’s Business Daily” Investor’s Business Daily, 10 Apr. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-jobs-report-tesla-cuts-u-s-ev-prices-again/

4. “US Equity Indices Drop As Traders Reassess Fed Hikes: Rate-Sensitive Real Estate, Tech Stocks Underperform …” Benzinga, 10 Apr. 2023, https://www.benzinga.com/news/earnings/23/04/31722957/nasdaq-s-p-500-futures-signal-subdued-open-for-data-heavy-week-analyst-says-fed-rate-hike-pause-on–

5. “S&P 500 Stalls at Trendline Resistance as Sentiment Sours. Where Next for Stocks?” DailyFX, 4 Apr. 2023, https://www.dailyfx.com/news/spx-sp-500-stalls-at-trendline-resistance-as-sentiment-sours-where-next-for-stocks-20230404.html

6. “Nasdaq falls 1% for three-day losing streak after weak economic data: Live updates” CNBC, 4 Apr. 2023, https://www.cnbc.com/2023/04/04/stock-market-today-live-updates.html

7. “Stock Market Today: Weak Economic Data Weighs on Stocks” Kiplinger’s Personal Finance, 5 Apr. 2023, https://www.kiplinger.com/investing/stocks/stock-market-today-weak-economic-data-weighs-on-stocks