On Monday, U.S. stock futures declined as traders looked ahead to further earnings reports and a significant address from Federal Reserve Chairman Jerome Powell.[0] The 10-year U.S. Treasury yield (US10Y) rose 10 basis points to 3.63%, while the 2-year yield (US2Y) rose 12 basis points to 4.41%. The Dow Jones Industrial Average (^DJI) shed about 100 points, or 0.3%, while the S&P 500 (^GSPC) stumbled 0.5% and the Nasdaq Composite (^IXIC) declined 0.7%.[1]

The 10-year U.S. Treasury yield (US10Y) rose 10 basis points to 3.64% and the 2-year yield (US2Y) rose 15 basis points to 4.45%. Announcing layoffs, Dell Technologies (DELL) declared it would be cutting approximately 6,650 jobs, equating to about 5% of its global employee base. This marks the latest in a series of technology companies to do the same.[1] At the beginning of the session, the shares decreased by 1.[1]

Monday was a quiet day on the economic calendar, and the same can be expected for the rest of the week, as attention turns to a range of Fed speakers who will be speaking.[2] “Given the blockbuster payrolls print, Fed Chair Powell’s speech at the Economic Club of Washington tomorrow could be the highlight,” said Investing.com analyst Jesse Reid.[0]

This week, notable companies that are releasing their earnings include Disney (DIS), BP (BP), PepsiCo (PEP), Uber (UBER), Chipotle Mexican Grill (CMG), and AbbVie (ABBV).[3] Tyson Foods (TSN) experienced a decrease of 5% in their stock price after announcing that their fiscal Q1 2023 earnings and sales were lower than anticipated.[4] Meta Platforms reported that their fourth-quarter earnings had declined by 52% from the same period a year prior, amounting to $1.76 per share, which was lower than the analysts’ consensus estimate.[5] The company unveiled a new $40 billion stock buyback program and in reaction, META stock surged 23.3% – its biggest one-day gain since 2013.[5]

It is anticipated that turbulence will continue in U.S. markets this week.[3] Friday’s jobs report, which was stronger than anticipated, thwarted the optimism of traders who had been anticipating that the Fed would possibly slow down the rate of interest hikes in the near future.[3]

0. “Stocks fall as higher rates rattle investors to start the week” CNBC, 6 Feb. 2023, https://www.cnbc.com/2023/02/05/stock-futures-slide-to-start-week-with-more-earnings-and-a-powell-speech-ahead.html

1. “Stock market news live updates: Stocks fall as investors ponder Fed’s rate path” Yahoo News, 6 Feb. 2023, https://news.yahoo.com/stock-market-news-live-updates-february-6-2023-111713832.html

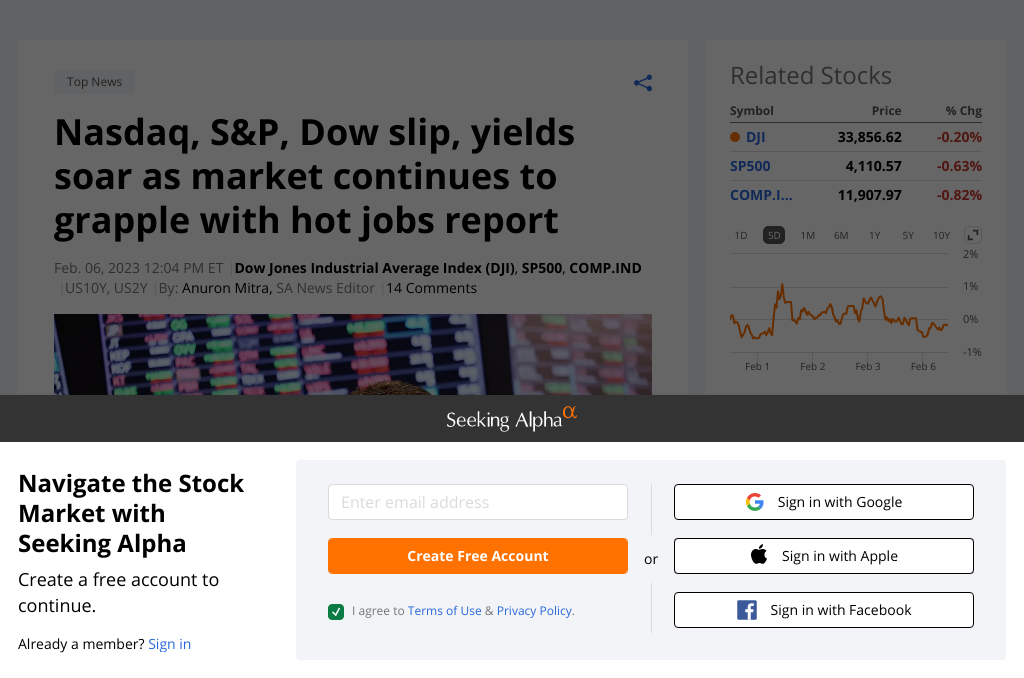

2. “Nasdaq, S&P, Dow slip, yields soar as market continues to grapple with hot jobs report” Seeking Alpha, 6 Feb. 2023, https://seekingalpha.com/news/3932372-sp500-nasdaq-dow-jones-stock-market-jobs-report-earnings

3. “Stock Market News Today: Monday Blues for Stocks at Open” TipRanks, 6 Feb. 2023, https://www.tipranks.com/news/stock-market-news-today-futures-down-on-solid-jobs-report-and-fed-speech-ahead

4. “Stock Market Bulls Take Profits Ahead Of Powell Speech; Onsemi Hot After Report | Investor’s Business Daily” Investor’s Business Daily, 6 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/stock-market-catches-it-breath-after-recent-gains-onsemi-shows-strength/

5. “Stock Market Today: Nasdaq Skyrockets After Meta Earnings, Buyback News” Kiplinger’s Personal Finance, 2 Feb. 2023, https://www.kiplinger.com/investing/stocks/stock-market-today-020223-nasdaq-skyrockets-after-meta-earnings-buyback-news