U.S. stocks finished higher on Friday, shaking off some of their recent weakness, while Treasury yields pulled back from key levels.[0] Wall Street’s major indices were also on track to end higher for the week, rallying after putting up their worst weekly performance of the new year.[1] The Dow Jones Industrial Average added 1.2% to 33,391, the S&P 500 lifted 1.6% to 4,045.7, and the Nasdaq Composite gained 2% to 11,689.

In the bond markets, United States 10-Year rates were at 3.956%, down -1.68%.[2] The Nasdaq increased by 2.0%, finishing at 11,689, while the S&P 500 rose 1.6%, settling at 4,045. The Dow also climbed 1.2%, concluding at 33,390. For the week, the indexes rose from 1.7% to 2.6%, with the S&P 500 having its first weekly victory since February 3rd and the Dow its first since January 27th.[3]

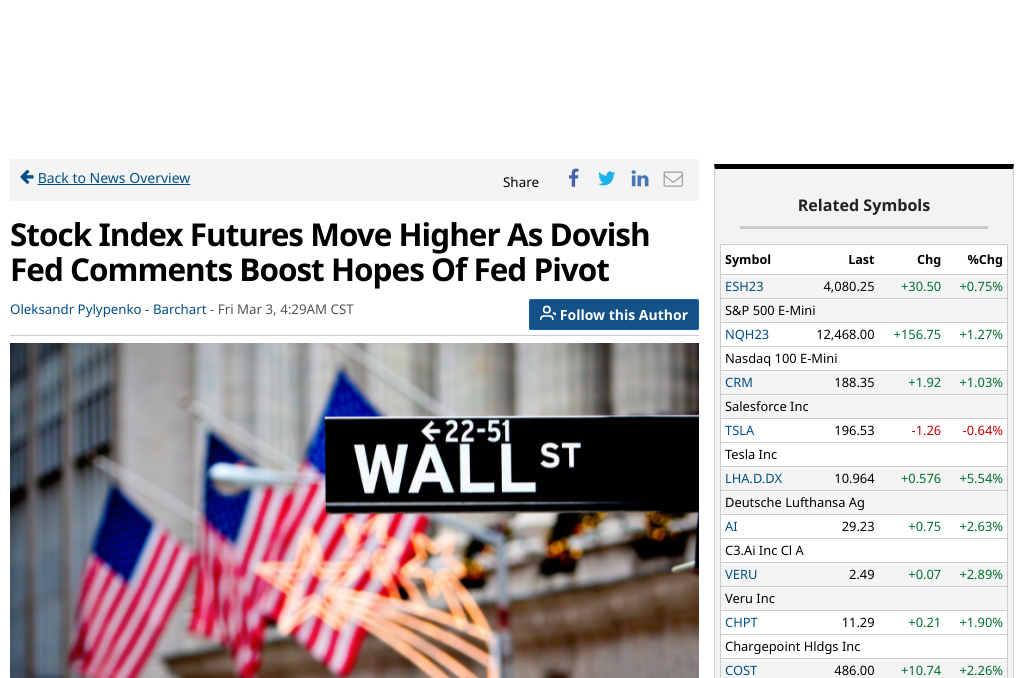

In single-stock news, shares of C3.ai (AI) shot up 33.7% after earnings.[4] For the third quarter of its fiscal year, the enterprise AI software firm posted a loss of 6 cents per share, which was smaller than expected, along with revenue of $66.7 million, which was higher than anticipated.[3] C3.ai provided an optimistic outlook for their revenue in the present quarter.[3] Tesla (TSLA) stock fell 5.9% after the electric vehicle maker unveiled its “Master Plan 3” at last night’s Investor Day.[5] Meanwhile, Snowflake (SNOW) tumbled 9% after its earnings report included a revenue outlook well below expectations.[6] On the other hand, Salesforce (CRM) surged 15% after the cloud-based business-software giant reported upbeat Q4 results and gave a strong Q1 and FY24 sales forecast.[6]

Raphael Bostic, President of the Federal Reserve Bank of Atlanta, expressed his preference for “steady” quarter-point rate hikes on Thursday, in order to minimize the threat posed to the economy. He noted that the repercussions of the increased rates may not become evident until springtime.[7] Bostic mentioned that the Fed could potentially halt the rate hikes sometime between mid-summer and late-summer.[8] He simultaneously cautioned that if inflation numbers exceeded expectations, it could impact Federal Reserve policy.[7]

0. “Stock market news today: Stocks rise to start busy week” Yahoo Canada Finance, 6 Mar. 2023, https://ca.finance.yahoo.com/news/stock-market-news-live-updates-march-6-2023-123642397.html

1. “Nasdaq, S&P, Dow climb as yields retreat; stocks heading for weekly gains (SP500)” Seeking Alpha, 3 Mar. 2023, https://seekingalpha.com/news/3943944-nasdaq-sp500-dow-jones-stock-market-services-data-earnings

2. “Stocks Mixed Before The Open As Bond Yields Tick Higher On Fed Concerns, ECB Minutes In Focus” Barchart, 2 Mar. 2023, https://www.barchart.com/story/news/14699726/stocks-mixed-before-the-open-as-bond-yields-tick-higher-on-fed-concerns-ecb-minutes-in-focus

3. “Stock Market Today: S&P 500 Snaps Weekly Losing Streak” Kiplinger’s Personal Finance, 3 Mar. 2023, https://www.kiplinger.com/investing/stocks/stock-market-today-030323-sandp-500-snaps-weekly-losing-streak

4. “Dow Jones Indexes Rise On Strong Business Activity; AI Stock Surges After Earnings; Tesla’s China Deliveries Up” Investor’s Business Daily, 3 Mar. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-other-indexes-strengthen-in-afternoon-trading-this-index-outperforms-market

5. “Dow Jones Rises As 10-Year Yield Tops 4%; Tesla Plunges 8% On Disappointing Investor Day” Investor’s Business Daily, 2 Mar. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-climb-ahead-of-jobless-claims-tesla-dives-on-disappointing-investor-day/

6. “Stock Market Rally Rebounds Despite Rising Yields; Salesforce, Tesla In Focus: Weekly Review | Investor’s Business …” Investor’s Business Daily, 3 Mar. 2023, https://www.investors.com/news/stock-market-rally-rebounds-despite-rising-yields-tesla-salesforce/

7. “Stock Index Futures Move Higher As Dovish Fed Comments Boost Hopes Of Fed Pivot” Barchart, 3 Mar. 2023, https://www.barchart.com/story/news/14739365/stock-index-futures-move-higher-as-dovish-fed-comments-boost-hopes-of-fed-pivot

8. “Dow Jones Rallies As Tesla Dives, Leads ‘Race To The Bottom’; Warren Buffett Stock Craters” Investor’s Business Daily, 2 Mar. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-gains-tesla-stock-dives-leads-race-to-the-bottom-warren-buffett-stock-craters-elon-musk