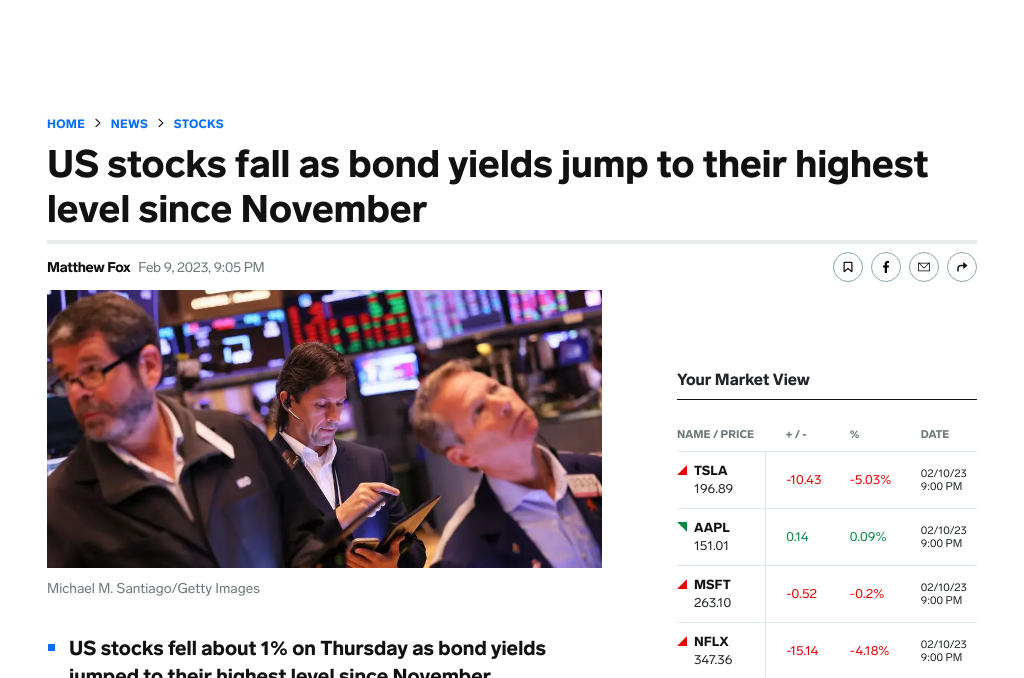

On Friday, the major US stock indexes ended the trading session mixed, with the Nasdaq Composite (COMP.IND) closing down 0.61% to 11,718.12 points, the S&P 500 (SPX.IND) down 0.88% to 4,081.52 points, and the Dow Jones Industrial Average (DJI.IND) down 0.73% to 33,699.88 points.[0] This marks the first weekly loss for the S&P 500 in three weeks and its worst one-week decline since December.[1] The tech-heavy Nasdaq led the weekly sell-off with a drop of more than 2%.[0]

Tesla (TSLA) saw a 3% increase in its closing price when it became apparent that their recent price decreases were stimulating interest in their electric vehicles. In January, 66,051 of their China-made cars were delivered, representing an 18.4% month-over-month growth.[2] Other Dow Jones tech giants Apple (AAPL) and Microsoft (MSFT) were also sharply higher after today’s stock market open.[3]

After its quarterly earnings report revealed a poor outlook, shares of Lyft (LYFT) saw a sharp decline.[4] The ridesharing company notched a massive stock decline on a disappointing earnings report, posting record revenue for a second consecutive quarter but issuing weak guidance.

West Texas Intermediate crude oil fell 1.1% to $77.63 a barrel, while the yield on the 10-year Treasury rose 6.4 basis points to 3.747%.[5]

The University of Michigan released its preliminary measure of February consumer sentiment, coming in at 66.4 versus the forecasted 65 figure.[6]

To date, 63% of the S&P 500 corporations have reported their fourth-quarter earnings.[7] Fundstrat reported that 68% of the companies have exceeded profit estimates with a median of 6%, and 63% of the companies have exceeded revenue estimates with a median of 4%.[8]

Christopher Waller, a Federal Reserve Governor, is scheduled to give a speech at 12:30 p.m [9] Earlier this week, he said at an Agribusiness conference in Arkansas that the central bank’s efforts are paying off and that it has more work to do.[9] Philadelphia Fed President Patrick Harker will also speak at 4 pm. Stocks have endured some pressure this week following hawkish remarks from Fed officials such as New York President John Williams and Waller.[4]

0. “US stocks end mixed after volatile session as indexes notch weekly losses” msnNOW, 10 Feb. 2023, https://www.msn.com/en-us/money/markets/us-stocks-end-mixed-after-volatile-session-as-indexes-notch-weekly-losses/ar-AA17lFoi

1. “Stock market news today: S&P 500 snaps streak of weekly gains” Markets Insider, 10 Feb. 2023, https://markets.businessinsider.com/news/stocks/stock-market-news-today-sp500-dow-jones-nasdaq-weekly-losses-2023-2

2. “Stocks Relinquish Early Gains and Close Lower as Bond Yields Climb” Barchart, 9 Feb. 2023, https://www.barchart.com/story/news/14072296/stocks-relinquish-early-gains-and-close-lower-as-bond-yields-climb

3. “Dow Jones Rallies 250 Points After Jobless Claims; Tesla Stock Doubles From Lows” Investor’s Business Daily, 9 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-rise-ahead-of-jobless-claims-disney-surges-on-earnings/

4. “Stocks end mostly higher, but S&P 500, Nasdaq book worst weekly losses since December” MarketWatch, 10 Feb. 2023, https://www.marketwatch.com/story/u-s-stock-futures-point-to-another-down-day-on-wall-street-amid-earnings-disappointment-e26059bc

5. “Stock Buyers’ Fatigue Kicks In as Bond Yields Jump: Markets Wrap” Yahoo! Voices, 9 Feb. 2023, https://www.yahoo.com/now/asia-stocks-face-declines-wall-230048868.html

6. “Nasdaq, S&P, Dow look for direction, set to end lower for the week on Fed concerns” Seeking Alpha, 10 Feb. 2023, https://seekingalpha.com/news/3934862-nasdaq-sp500-dow-jones-stock-market-fed-earnings

7. “Dow closes nearly 250 points lower, Nasdaq sheds 1% as Alphabet shares slide: Live updates” CNBC, 9 Feb. 2023, https://www.cnbc.com/2023/02/08/stock-market-futures-open-to-close-news.html

8. “Stock market news today: Rising interest rates help spoil early gains” Markets Insider, 9 Feb. 2023, https://markets.businessinsider.com/news/stocks/stock-market-news-today-rising-interest-rates-highest-level-november-2023-2

9. “US Stocks Look Set To Steepen Losses For Week As Nasdaq, S&P Futures Plunge – Invesco QQQ Trust, Series 1” Benzinga, 10 Feb. 2023, https://www.benzinga.com/news/earnings/23/02/30851938/us-stocks-look-set-to-steepen-losses-for-week-as-nasdaq-s-p-futures-plunge-focus-on-inflation-data–