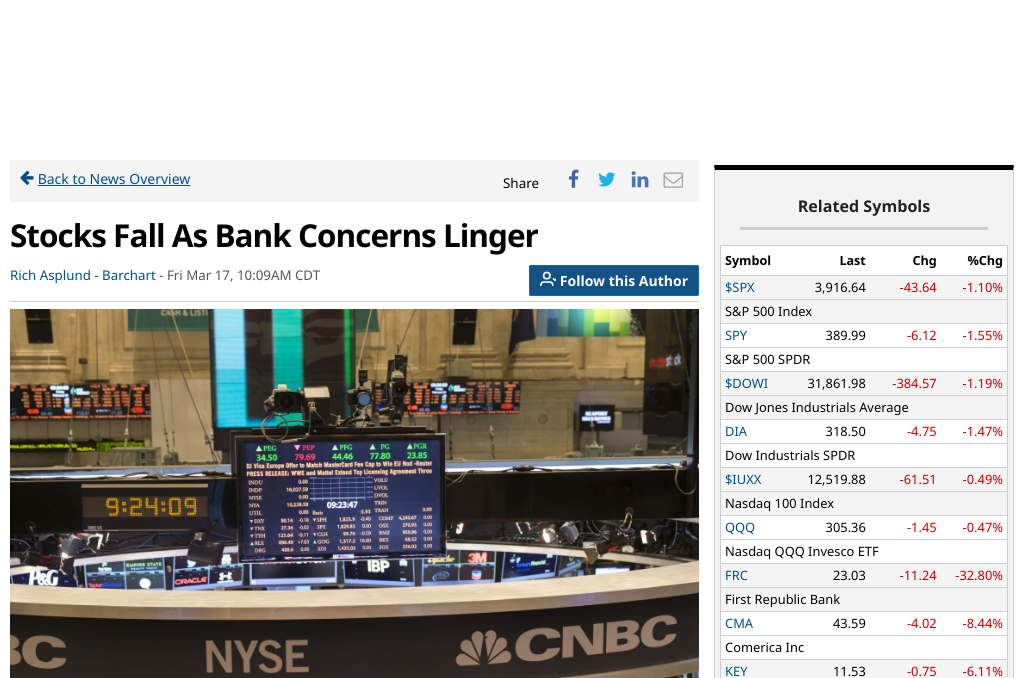

The banking sector has been in turmoil this week, with regional banks facing a rough week and shares of First Republic Bank (NYSE: FRC) tumbling more than -12% in pre-market trading.[0] The stock reversed earlier losses and rallied almost 10% as a group of 11 banks, including Bank of America and Goldman Sachs, agreed to deposit $30 billion in First Republic.[1] Shares of Zions Bancorp and KeyCorp, which are among the regional banks facing a rough week, fell more than 2%.[1]

Thursday saw JP Morgan (JPM), Bank of America (BAC), and Citigroup (C) take the lead in a consortium of 11 U.S. banks, pooling together $30 billion in uninsured deposits to prop up faltering lender First Republic (FRC).[2] The move reflects the banks’ confidence in the country’s banking system, and their commitment to helping banks serve their customers and communities.[3]

The package-shipping company FedEx (FDX) was up more than +7% to lead gainers in the S&P 500 after reporting Q3 adjusted EPS of $3.41, well above the consensus of $2.71, and raising its full-year adjusted EPS forecast to $14.60-$15.20 from a previous forecast of $13.00-$14.00, stronger than the consensus of $13.57.[4]

Meanwhile, the SPDR S&P Regional Banking ETF (KRE) slumped 24.5% in the past seven trading days since March 9, a day after SVB announced it sold a portfolio of securities at a more than $1 billion loss.[5] Regulators shut down the bank on March 10 as depositors began to withdraw their funds.[5]

At First Republic, 68% of its deposit accounts are not insured by the FDIC above the $250,000 limit. If customers were to demand their deposits be paid back in cash, First Republic would have to liquidate assets or take out loans in order to meet the demand.[6]

President Joe Biden has urged Congress to give regulators the authority to recover payouts to bank executives after a collapse.[7] Executives at First Republic Bank and Silicon Valley Bank sold company’s stock worth millions of dollars in the months before this week’s crash, according to The Wall Street Journal. First Republic’s chief credit officer and chief risk officer sold shares just two days before the Silicon Valley Bank implosion.

0. “FRC Tanks after it Suspends Dividends” TipRanks, 17 Mar. 2023, https://www.tipranks.com/news/frc-tanks-as-it-suspends-dividends

1. “Stock market today: Live updates” CNBC, 17 Mar. 2023, https://www.cnbc.com/2023/03/16/stock-market-today-live-updates.html

2. “First Republic Gets $30 Billion Lifeline from JPMorgan, Citi, Bank of America, Wells Fargo” Investopedia, 16 Mar. 2023, https://www.investopedia.com/first-republic-s-usd30b-rescue-by-jp-morgan-citi-and-bank-of-america-7367932

3. “US banks launch $30bn rescue of First Republic to stem spiraling crisis” The Guardian, 16 Mar. 2023, https://www.theguardian.com/business/2023/mar/16/first-republic-bank-rescued-latest

4. “Stocks Fall As Bank Concerns Linger” Barchart, 17 Mar. 2023, https://www.barchart.com/story/news/15159208/stocks-fall-as-bank-concerns-linger

5. “From SVB’s sudden collapse to Credit Suisse’s fallout: 8 charts show turbulence in financial markets” MarketWatch, 17 Mar. 2023, https://www.marketwatch.com/story/from-svbs-sudden-collapse-to-credit-suisses-fallout-8-charts-show-turbulence-in-financial-markets-48caa0f3

6. “Major banks pledge $30 billion rescue for First Republic” The Week, 17 Mar. 2023, https://theweek.com/us/1021872/major-banks-pledge-30-billion-rescue-for-first-republic

7. “Fed loans, account guarantees helped stabilize ‘deposit flows’ at regional banks, Treasury official says” CNBC, 17 Mar. 2023, https://www.cnbc.com/2023/03/17/svb-collapse-fed-loans-account-guarantees-helped-stabilize-deposit-flows-at-regional-banks-treasury-official-says.html