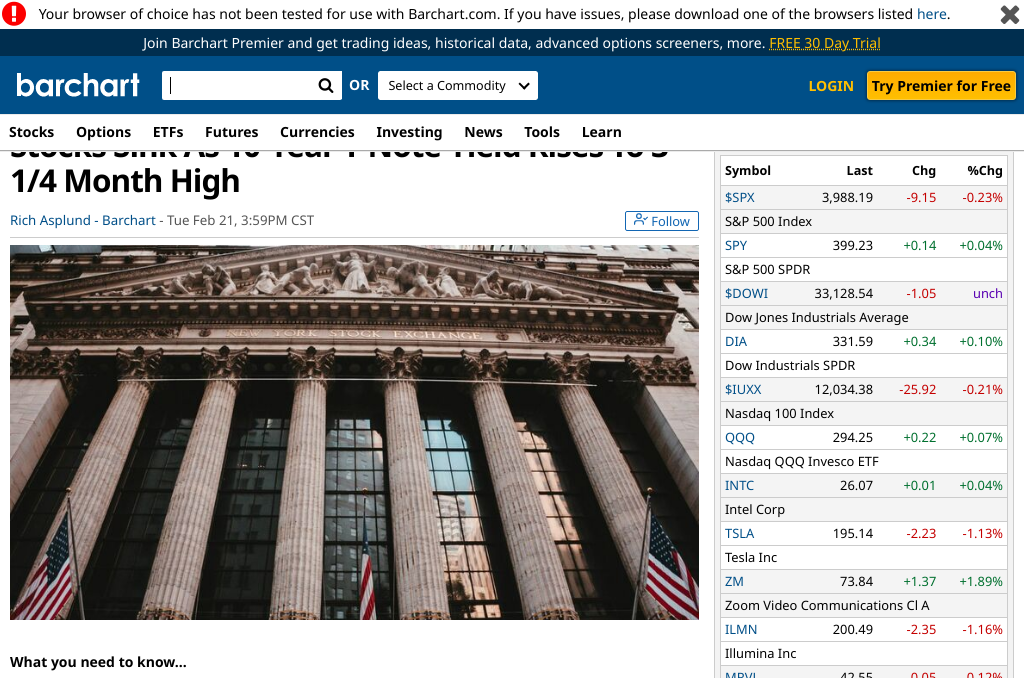

Investors are bracing for volatility in the markets as the Federal Open Market Committee (FOMC) releases their minutes from the Jan. 31-Feb.[0] 1 meeting on Wednesday.[1] The minutes may shed light on what the central bank has in store for future rate hikes, including its most recent 25-basis-point increase.[2] Investors are predicting a higher likelihood of more interest rate increases in 2023, and anticipate inflation to stay at high levels.[3] Yesterday, Treasury yields reached an unprecedented high, as worries of an unavoidable recession gain traction.

The preparations have been completed for the unveiling of the minutes from the Federal Reserve’s earlier gathering. These documents will be analyzed closely in order to gain a better understanding of how far policymakers believe they must raise interest rates in order to restrain the persistent inflation.[4] The yield on the 10-year U.S. Treasury rose to 3.95% on Tuesday, with the closing rate being the highest since November 9th. On Wednesday morning, the 10-year yield dipped to 3.91% in anticipation of the Fed minutes for the day.[5]

Shares of Home Depot (NYSE:HD) tumbled by over 7% after the company announced its fourth-quarter results, which fell short of expectations, and projected that its earnings per share for 2023 would decrease by a mid-single-digit percentage, as opposed to Wall Street’s forecast of a flat performance.[6] Meanwhile, Palo Alto Networks’ (PANW) stock jumped nearly 12% after the cybersecurity firm raised its annual profit outlook and said it was working on managing costs.[7] UBS’s downgrade of DocuSign (NASDAQ:DOCU) from Neutral to Sell, due to worries about growth, caused the stock to fall 10%.[6]

Carol Schleif, chief investment officer of BMO Family Office said in a note, “While the stock market has staged an impressive rebound so far this year, markets are still trying to adjust to the reality that the Federal Reserve is unlikely to pivot and is instead still focused on fighting inflation, which suggests that investors should be prepared for interest rates to stay higher for longer.”[7] Jeffrey Roach, chief economist for LPL Financial added, “A tight labour market and resilient consumer demand could goad the Federal Reserve to maintain its rate hiking campaign into the summertime. Investors should expect volatility until markets and central bankers come to agreement on the expected path for interest rates.”[0]

Bloomberg reported that Dow Jones futures rose 0.2% vs. fair value.[8] The S&P 500 futures increased by[1]

0. “Stocks are tanking today because of fears the Fed is nowhere near winding up its inflation fight” Financial Post, 21 Feb. 2023, https://financialpost.com/investing/stocks-fall-fed-fears

1. “Dow Jones Futures Rise: S&P 500 Nears Key Support As Nvidia Earnings Loom; Here’s What To Do Now | Investor’s …” Investor’s Business Daily, 22 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-tumbles-sp-nears-key-support-nvidia-earnings/

2. “Fed Minutes Are Released Today. What to Expect This Time.” Barron’s, 22 Feb. 2023, https://www.barrons.com/articles/fed-minutes-stocks-federal-reserve-interest-rates-markets-b19c6099

3. “Stock Market News Today: Tech Leads Stocks Ahead of FOMC Meeting” TipRanks, 22 Feb. 2023, https://www.tipranks.com/news/stock-market-news-today-futures-inch-up-ahead-of-fomc-minutes

4. “Dow futures largely flat; Fed minutes to determine market direction By Investing.com” Investing.com, 22 Feb. 2023, https://www.investing.com/news/stock-market-news/dow-futures-largely-flat-fed-minutes-to-determine-market-direction-3010308

5. “Dow Jones Rises Ahead Of Fed Minutes; Baidu Surges On Earnings; Nvidia Earnings Next” Investor’s Business Daily, 22 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-rise-ahead-of-fed-minutes-nvidia-earnings-on-deck/

6. “Stocks Sink As 10-Year T-Note Yield Rises To 3-1/4 Month High” Barchart, 21 Feb. 2023, https://www.barchart.com/story/news/14410202/stocks-sink-as-10-year-t-note-yield-rises-to-3-1-4-month-high

7. “Stock market news today: Stocks edge higher after sharp sell-off” Yahoo News, 22 Feb. 2023, https://news.yahoo.com/stock-market-news-today-february-22-2023-120842564.html

8. “US Stock Futures Inch Higher Ahead of Fed Minutes: Markets Wrap” Yahoo! Voices, 22 Feb. 2023, https://www.yahoo.com/now/asia-stocks-us-shares-lower-223133948.html