Shares of Nvidia (NVDA) are soaring after the software company posted better-than-expected results in the previous quarter while boosting current quarter guidance, and said chip demand for artificial intelligence (AI) applications such as ChatGPT is surging. On Thursday, NVDA shares leaped 14% as investors were tantalized by the prospect of an artificial intelligence-driven boom in chip demand.

Nvidia (NASDAQ:NVDA) reported stronger-than-expected fourth-quarter results and guidance, leading to a 14% surge in its stock price on Thursday. Wall Street analysts praised the chip maker’s strong performance.[0] The S&P 500 Index SPX, +0.31% rose 0.31% to 3,982.24, the Dow Jones Industrial Average DJIA, +0.22% rose 0.22% to 32,889.09, and the Nasdaq Composite was up 0.72%.[1]

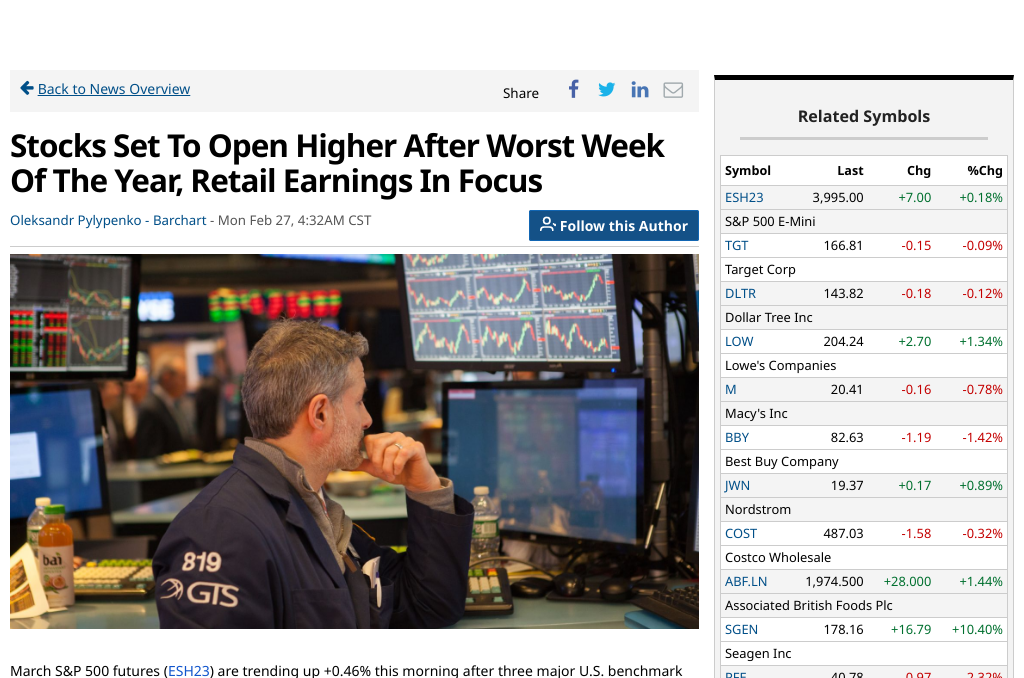

Seagen Inc. (NASDAQ:SGEN) shares jumped more than 10% after a report from The Wall Street Journal said Pfizer (PFE) is in early-stage talks to acquire the cancer drugmaker in what could be a multi-billion dollar deal.[2]

In economic news, data on Friday showed the core PCE Price Index, which is the Fed’s preferred gauge of inflation, stood at +0.6% m/m and +4.7% y/y in January, stronger than expectations of +0.4% m/m and +4.3% y/y, adding to worries that the Fed may have to keep rates higher for longer to tame inflation. U.S. personal spending increased by an amount not seen in 1-3/4 years, with a jump of +1.8% m/m in January, surpassing the expected +1.3% m/m.[3] Moreover, the Consumer Sentiment Index of the University of Michigan reached a 13-month peak of 67.0 in February.[3]

Currently, the spotlight is on the U.S. core personal consumption expenditures (PCE) price index, the Federal Reserve’s primary measure of inflation, which will be reported in a couple of hours.[4] Economists predict that the Core PCE Price Index in January will be +0.4% month-over-month and +4.3% year-over-year, which is higher than the previous numbers of +0.3% m/m and +4%.

0. “Why did Nvidia stock jump up today? Strong Q4, guidance leads to praise (NVDA)” Seeking Alpha, 23 Feb. 2023, https://seekingalpha.com/news/3940241-why-did-nvidia-stock-jump-up-today-strong-q4-guidance-leads-to-praise

1. “Stock Market Today: Nasdaq Outperforms as Nvidia Outlook Impresses” Kiplinger’s Personal Finance, 23 Feb. 2023, https://www.kiplinger.com/investing/stocks/stock-market-today-022323-nasdaq-outperforms-as-nvidia-outlook-impresses

2. “Stock market news today: Stocks rise as Wall Street rebounds from worst week of 2023” Yahoo News, 27 Feb. 2023, https://news.yahoo.com/stock-market-news-live-updates-february-27-2023-130555308.html

3. “Stocks Set To Open Higher After Worst Week Of The Year, Retail Earnings In Focus” Barchart, 27 Feb. 2023, https://www.barchart.com/story/news/14581554/stocks-set-to-open-higher-after-worst-week-of-the-year-retail-earnings-in-focus

4. “Futures are Signaling a Weak Open for Wall Street, U.S. PCE Data In Focus” Barchart, 24 Feb. 2023, https://www.barchart.com/story/news/14518036/futures-are-signaling-a-weak-open-for-wall-street-u-s-pce-data-in-focus