In January, the United States economy saw a considerable surge in job growth, with 517,000 jobs added – far surpassing the predicted 187,000 increase – and a drop in unemployment to 3.4%, the lowest since 1969.[0] Hourly earnings increased by an average of 0.3%, as anticipated.[1] The Dow Jones Industrial Average experienced a 0.1% decrease on Thursday, whereas the S&P 500 saw a 1.5% rise. The Nasdaq composite rose significantly by 3.3%, while the small-cap Russell 2000 increased by 2.1%.[2] At the start of trading on Friday, the Dow Jones Industrial Average declined by 0.4%, while the S&P 500 decreased by 0.8%. The Nasdaq composite, which is technology-centric, dropped 0.9%, with Alphabet, Amazon and Apple contributing to the decrease.

The jobs report out on Friday showed a blowout number of 517,000 gain in employment, while the unemployment rate fell to its lowest level since 1969.[1] Hourly earnings increased by an average of 0.3%, as anticipated.[1] The S&P 500 fell by 1.04%, resulting[3] The Nasdaq Composite decreased by approximately 1.59%, ending at 12,006. In contrast, the Dow Jones Industrial Average dropped 127.93 points, or 0.38%, to 33,926.01.[4]

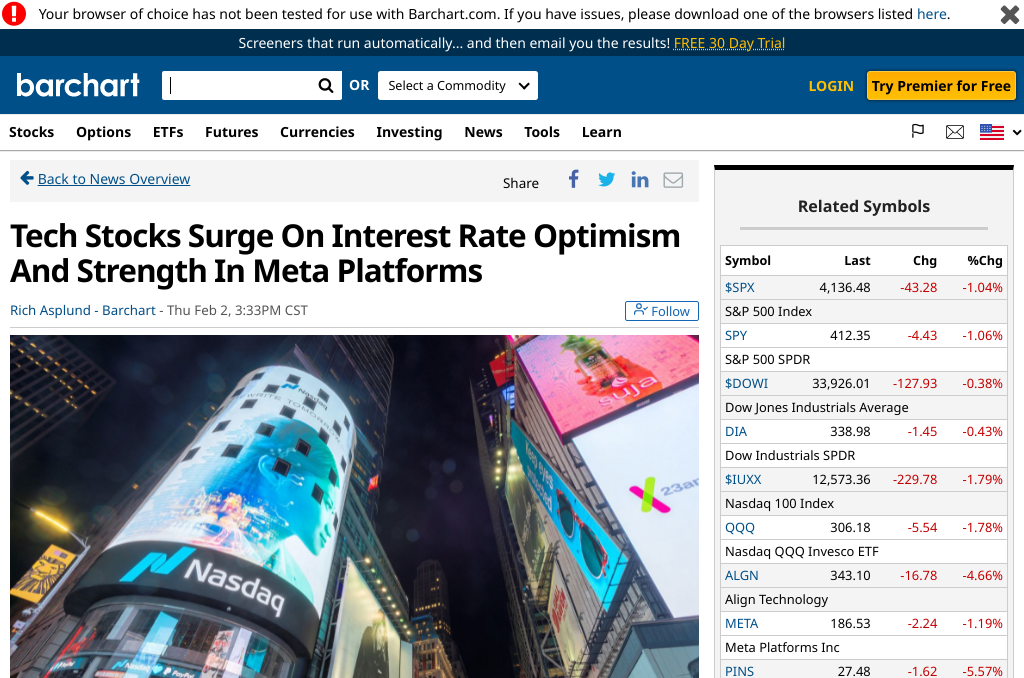

Nordstrom (NYSE:JWN) experienced a significant increase of 23% in share value as Ryan Cohen, an activist investor, is said to have acquired an interest and is reportedly aiming to make alterations to the board.[5] Amazon (AMZN), Alphabet (GOOGL) and other stocks that receive a bulk of their revenue from digital advertising also rallied on the news, with Pinterest (PINS) closing up more than 8%, and Alphabet (GOOGL) and Amazon.com (AMZN) closing up more than 7%.[6]

META Platforms (META) announced an EPS decrease of 52%, in accordance with expectations, while revenue decreased by 4%, slightly surpassing estimates.[7] Stock prices rose sharply as the company that owns Facebook declared its intention to make 2023 a “year of efficiency” after spending heavily on the metaverse in 2022.[8] Q1 revenue was closely monitored by Meta and capital spending as well as other projected costs for the year were significantly reduced.[7] The company also declared a $40 billion repurchase.[8]

On Thursday, Alphabet’s shares declined 2.6% as its December-quarter earnings and revenue were lower than what analysts had anticipated.[2] Declining expansion in web search advertising, YouTube promotions, and cloud computing services had a negative effect on results.[2]

0. “Stock market news live updates: Stocks slide after jobs report shocks, Big Tech results disappoint” Yahoo News, 3 Feb. 2023, https://news.yahoo.com/stock-market-news-live-updates-february-3-2023-122332716.html

1. “U.S. stocks fall after blowout jobs report, disappointing earnings, but Nasdaq books longest weekly win streak since November 2021” MarketWatch, 3 Feb. 2023, https://www.marketwatch.com/story/u-s-stock-futures-tumble-ahead-of-jobs-data-with-tech-under-pressure-as-apple-amazon-and-alphabet-fall-after-results-11675422809

2. “Dow Jones Slides 175 Points On Stunning Jobs Report; Apple Stock Reverses Higher On Earnings” Investor’s Business Daily, 3 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-fall-ahead-of-january-jobs-report-alphabet-amazon-apple-drop-on-earnings/

3. “S&P 500, Dow, Nasdaq slump as job gains raise Fed worries (SP500)” Seeking Alpha, 3 Feb. 2023, https://seekingalpha.com/news/3932039-sp-500-dow-nasdaq-slump-as-job-gains-raise-fed-worries

4. “Stocks fall on Friday, but S&P 500 notches winning week as strong 2023 continues” CNBC, 3 Feb. 2023, https://www.cnbc.com/2023/02/02/stock-futures-fall-after-earnings-reports-from-apple-alphabet-disappoint-investors.html

5. “S&P 500 slides as blowout jobs report dents Fed pause hopes By Investing.com” Investing.com, 3 Feb. 2023, https://www.investing.com/news/stock-market-news/sp-500-slides-as-blowout-jobs-report-dents-fed-pause-hopes-2995288

6. “Tech Stocks Surge on Interest Rate Optimism and Strength in Meta Platforms” Barchart, 2 Feb. 2023, https://www.barchart.com/story/news/13855473/tech-stocks-surge-on-interest-rate-optimism-and-strength-in-meta-platforms

7. “Stock Market Today: Nasdaq Skyrockets After Meta Earnings, Buyback News” Kiplinger’s Personal Finance, 2 Feb. 2023, https://www.kiplinger.com/investing/stocks/stock-market-today-020223-nasdaq-skyrockets-after-meta-earnings-buyback-news

8. “Market Rally Powers Higher On Tame Fed, Meta: Weekly Review” Investor’s Business Daily, 3 Feb. 2023, https://www.investors.com/news/market-rally-powers-higher-on-tame-fed-meta-earnings-apple-google-amazon/