The U.S. Bureau of Labor Statistics released inflation data for February on Tuesday morning, showing the consumer price index rose 0.4% in the month, in line with expectations, and the annual inflation rate remained stubbornly high at 6%.[0] Core CPI, which excludes food and energy, was higher than expected at 0.5% and the annual inflation rate moderated to 5.5%.[1] This data adds to evidence that inflation remains high, though the ongoing fallout from the Silicon Valley Bank collapse over the coming days is likely to have a bigger bearing on the Federal Reserve’s rate decision at its March 22 policy meeting.[2]

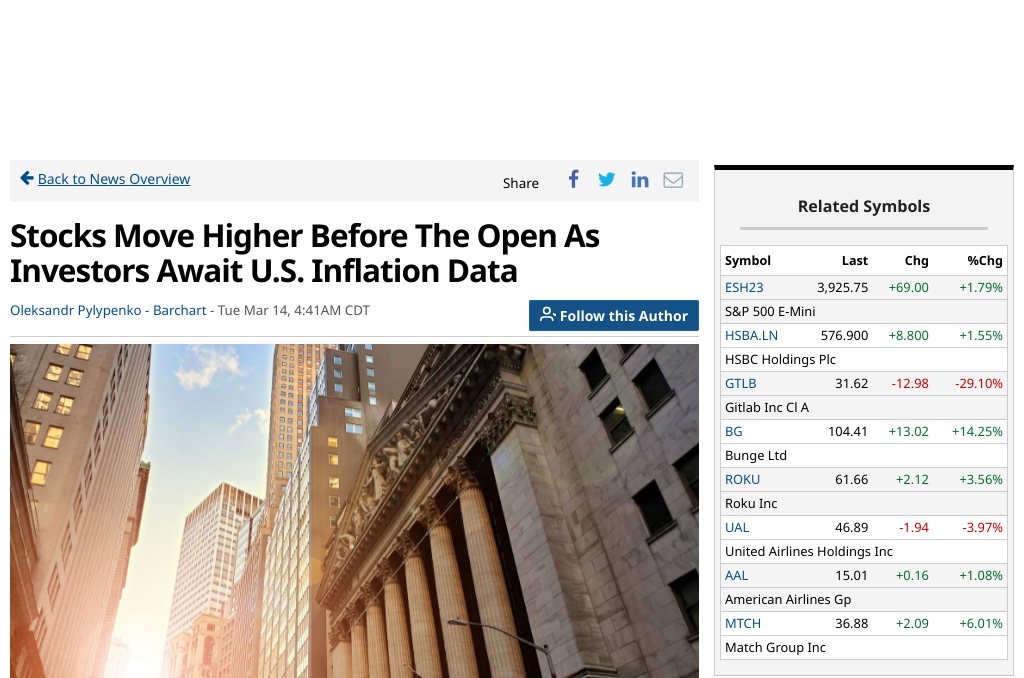

U.S. stock futures inched higher on Tuesday ahead of the consumer inflation report due later in the day as investors await clues on the pace of interest rate hikes by the Federal Reserve.[3] Following the CPI release, the Dow Jones Industrial Average rose 1%, while the S&P 500 gained 1.3% and the Nasdaq Composite advanced 1.5%.[4] Treasury yields moved higher and the 10-year U.S. Treasury yield dived to 3.51% on Monday due to safe haven trade, before rebounding to 3.59% in morning trade on Tuesday.[5]

The market reaction to the CPI data suggests the probability of a rate hike at the Fed’s March 22 policy meeting has increased, with traders now pricing in an ~85% chance of a 0.25 percentage point increase, according to a CME Group estimate.[6] This is up from around 73% last week.

In Asia, stocks ended the trading session in the red, with Hong Kong’s Hang Seng, China’s Shanghai Composite, and Shenzhen Component indices down 2.27%, 0.72%, and 0.78%, respectively. Meanwhile, GitLab (GTLB) plunged over 30% in pre-market trading after the company reported a weaker revenue forecast for the fiscal first quarter and year, missing analysts’ expectations.[7] United Airlines Holdings Inc (UAL) also slid more than 6% in pre-market trading after the company provided a pessimistic outlook for the first quarter of 2023.[5]

The Federal Reserve has hiked interest rates by a cumulative 4.5% over the past year in an effort to quell inflation, with consumer prices peaking last summer at a 40-year high of 9.1%.[8]

0. “SVB collapse causes concern for U.S. economy ahead of CPI report” NBC News, 14 Mar. 2023, https://www.nbcnews.com/business/business-news/svb-collapse-cpi-report-us-economy-rcna74747

1. “US financial stability trumps near-term inflation” ING Think, 14 Mar. 2023, https://think.ing.com/articles/us-financial-stability-trumps-near-term-inflation/

2. “US inflation tumbles to lowest level since September 2021 but price pressures complicate Fed rate decision” msnNOW, 14 Mar. 2023, https://www.msn.com/en-us/money/markets/us-inflation-tumbles-to-lowest-level-since-september-2021-but-price-pressures-complicate-fed-rate-decision/ar-AA18CaUZ

3. “Dow, S&P, Nasdaq futures inch higher ahead of inflation report” Seeking Alpha, 14 Mar. 2023, https://seekingalpha.com/news/3947160-dow-nasdaq-sp-futures-cpi-inflation-fed

4. “U.S. stocks open higher after headline CPI data show February inflation was in line with expectations” MarketWatch, 14 Mar. 2023, https://www.marketwatch.com/story/u-s-stocks-open-higher-after-headline-cpi-data-show-february-inflation-was-in-line-with-expectations-25db4863

5. “Stocks Move Higher Before the Open as Investors Await U.S. Inflation Data” Barchart, 14 Mar. 2023, https://www.barchart.com/story/news/15043283/stocks-move-higher-before-the-open-as-investors-await-u-s-inflation-data

6. “Inflation gauge increased 0.4% in February, as expected and up 6% from a year ago” CNBC, 14 Mar. 2023, https://www.cnbc.com/2023/03/14/cpi-inflation-february-2023-.html

7. “Dow Jones Rallies On Key Inflation Report; First Republic Surges 62% On Easing Bank Fears” Investor’s Business Daily, 14 Mar. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-futures-rise-ahead-of-key-inflation-report-first-republic-surges-43-on-easing-bank-fears/

8. “Inflation data arrives at critical moment for Fed after bank failures, jobs data” Yahoo News, 13 Mar. 2023, https://news.yahoo.com/inflation-data-arrives-at-critical-moment-for-fed-after-bank-failures-jobs-data-192322720.html