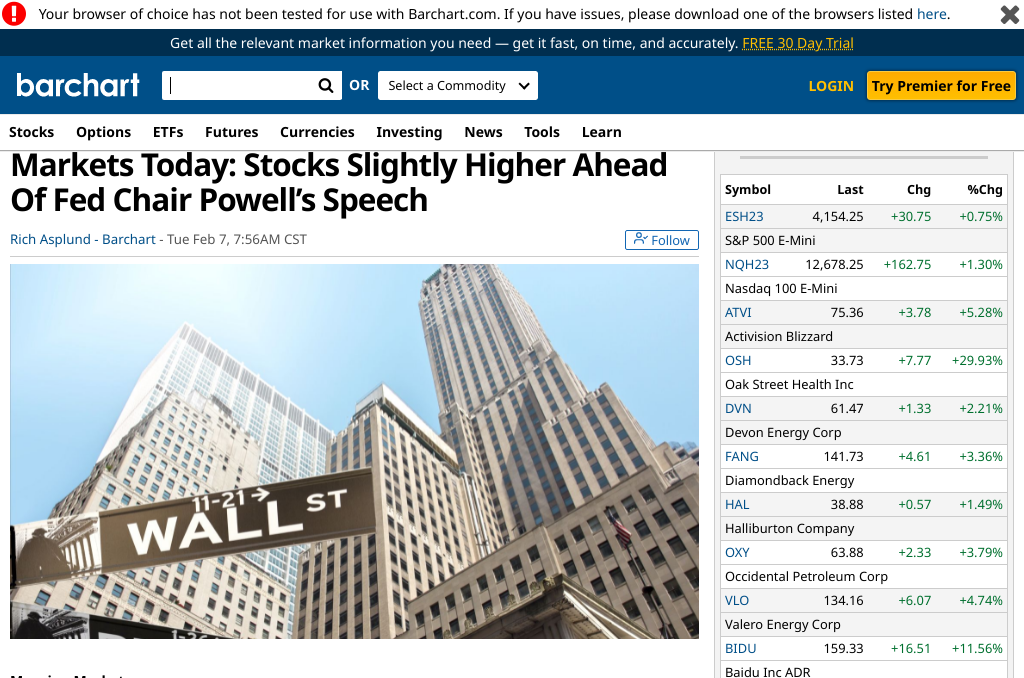

On Monday, the U.S. stock markets opened mostly lower, with the Dow Jones Industrial Average (DJIA) down 0.1%, and the S&P 500 (S&P5) and Nasdaq Composite (NASD) both slipping 0.6% and 1.0%, respectively.[0] Investors were cautious as they awaited Federal Reserve Chair Jerome Powell’s speech before the Economic Club of Washington. Traders are paying close attention to what Mr. Powell will say in response to the robust jobs report from last Friday, particularly if he suggests that the highest rate of interest may be higher than what was considered likely before.[1]

Oak Street Health (OSH) surged more than 30% in pre-market trading after the Wall Street Journal reported that the company is close to an agreement to be acquired by CVS Health (CVS) for about $10.5 billion.[1] CVS stock was up 0.5% on the news.

Activision Blizzard (ATVI) rose over 5% after earnings, while Baidu (BIDU) skyrocketed after unveiling plans to launch its own AI chatbot, with shares rising over 10% in strong volume.[2]

On Tuesday, Federal Reserve Chairman Jerome Powell reiterated that continued interest-rate increases will be appropriate, and that the “disinflationary process” has begun, in his first remarks since January’s blockbuster jobs report.[3] Powell said that wage increases were moderating closer to what is sustainable with the 2% target inflation.[2] He also noted that it will take “not just this year but next year to get down to 2%,” and that rates will have to remain at a restrictive level for a period of time before that happens.[4]

Minneapolis Fed President Neel Kashkari told Bloomberg News that the strong jobs report underscored the reality that the Fed’s job is not finished, and that he is sticking to his assessment that rates need to climb to around 5.4 percent, higher than the median forecast of 5.1% at the end of this year.[5]

As investors eagerly await Powell’s speech, markets are hoping for any indications of the future interest rate trajectory after last Friday’s jobs report came in significantly better than anticipated. Powell’s remarks, which were assertive in nature, will determine the market’s direction in the days ahead.[6]

0. “Stock Market Today: Dow, Nasdaq Edge Higher After Remarks By Fed’s Powell” The Wall Street Journal, 7 Feb. 2023, https://www.wsj.com/livecoverage/stock-market-news-today-02-07-2023

1. “Markets Today: Stocks Slightly Higher Ahead of Fed Chair Powell’s Speech” Barchart, 7 Feb. 2023, https://www.barchart.com/story/news/13975845/markets-today-stocks-slightly-higher-ahead-of-fed-chair-powells-speech

2. “S&P 500 Flashes Bullish Golden Cross On Powell Inflation Control; Apple, Microsoft Show Healthy Pullbacks” Investor’s Business Daily, 7 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-falls-market-awaits-powell-test-for-next-run-apple-microsoft-set-up-in-healthy-pullback

3. “Fed Chair Jerome Powell Says the ‘Disinflationary Process’ Has Begun” Barron’s, 7 Feb. 2023, https://www.barrons.com/articles/fed-chair-jerome-powell-speech-talk-live-today-51675787406

4. “Fed Chair Powell delivers first public remarks since monster jobs report” CNN, 7 Feb. 2023, https://www.cnn.com/2023/02/07/economy/jerome-powell-economic-club-speech/index.html

5. “Fed’s Powell speaks on economy, job market” The Washington Post, 7 Feb. 2023, https://www.washingtonpost.com/business/2023/02/07/powell-economy-jobs/

6. “Stock Market News Today: Indices Give Up Gains and Turn Negative” TipRanks, 7 Feb. 2023, https://www.tipranks.com/news/stock-market-news-today-futures-up-ahead-of-powell-speech