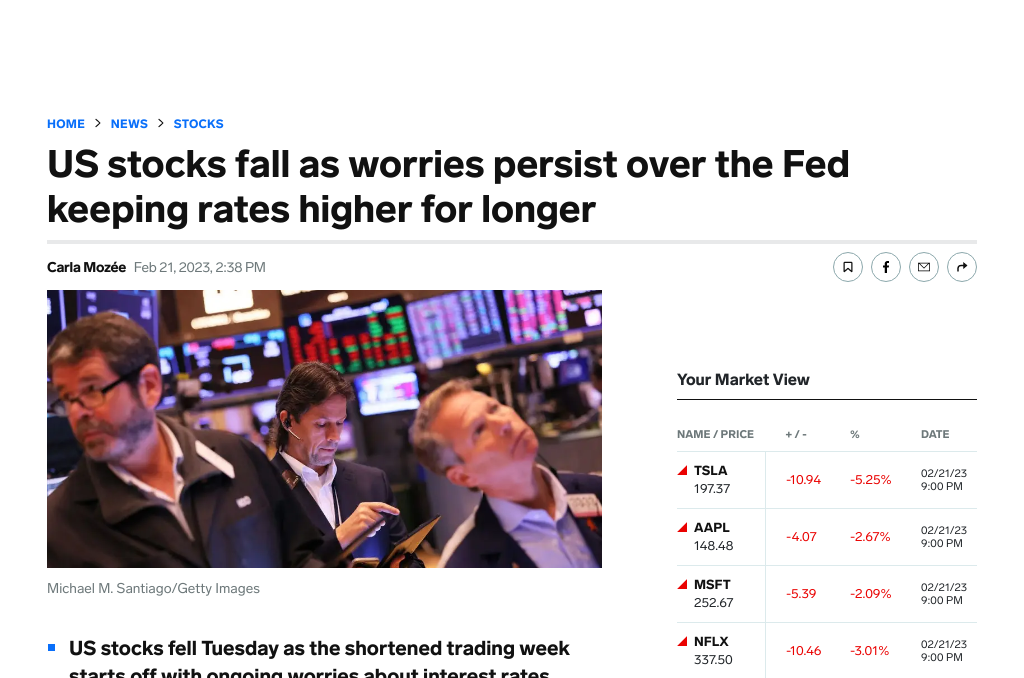

U.S. stocks fell on Tuesday, starting the holiday-shortened trading week on a sour note, as grim forecasts from retail giants Walmart and Home Depot strengthened the case for more tightening by the Federal Reserve.[0] The Dow Jones Industrial Average (DJI) dropped 697.1 points or 2.1% to 33,129.6, the S&P 500 (SP500) fell 81.8 points or 2% to 3,997.4 and the NASDAQ Composite (IXIC) shed 295 points or 2.5% to 11,491.3.[1]

Bond market rates rose.[2] The US10Y 10-year Treasury yield increased by 13 basis points to reach 3.96%, while the US2Y 2-year yield experienced a 11 basis point uptick to 4.73%. The yield on the 10-year Treasury note rose sharply, reaching 3.91%, its highest level in three months and nearing the 4% psychological barrier again. The 30-year bond dropped to its lowest point in seven weeks[3] CME FedWatch states that the chances of a 0.25% rate increase at the upcoming March gathering are at 76%.[3]

After facing increased supply chain expenses and weaker demand, Home Depot, Inc. (NYSE:HD), the home improvement retailer, has issued a profit forecast that was lower than expected.[4] The stock price of Home Depot dropped by over 5%.[4] Walmart Inc. (NYSE:WMT), the biggest retailer in the United States, predicted annual earnings that were lower than expected.[4] Bargain-seeking by consumers may have a negative effect on its margins.[4] Walmart’s stock regained its losses and was up 0.6% in trading.[4]

The most recent economic figures have been positive.[5] Traders are concerned that the Fed, which is already taking a hawkish stance, will keep interest rates higher for a prolonged period due to sticky inflation and warnings from major retailers, such as Walmart and Home Depot.[5] It is highly likely (80% chance) that three more quarter-point rate hikes will occur in the near future, with an increasing likelihood that a half-point move may take place either in March or May.[6]

On Wednesday night, Nvidia’s (NVDA) earnings report will be released, which is a key event for not only the semiconductor sector but also the entire stock market rally. Nvidia, a US-based chip corporation, will be releasing its earnings report on Wednesday after the market closes. Thus far in 2023, NVDA has been one of the industry’s top performers, with its stock rising more than 100% from its October 2022 nadir.[7]

0. “Stock market news today: S&P 500 on track for 3rd losing session” Markets Insider, 21 Feb. 2023, https://markets.businessinsider.com/news/stocks/stock-market-news-today-dow-nasdaq-fed-rates-warning-crash-2023-2

1. “Stock market news today: Stocks slide after economic warnings from Walmart, Home Depot” Yahoo News, 21 Feb. 2023, https://news.yahoo.com/stock-market-news-today-february-21-2023-110046104.html

2. “Dow, Nasdaq, S&P 500 all fall at least 2% amid ‘toxic’ macro uncertainty” Seeking Alpha, 21 Feb. 2023, https://seekingalpha.com/news/3938694-dow-nasdaq-sp-500-all-fall-at-least-2-amid-toxic-macro-uncertainty

3. “Home Depot Sinks Stock Market; S&P 500 Breaks Support; Meme Stock DraftKings Probes Buy Signal” Investor’s Business Daily, 21 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-retailers-sink-stock-market-s-meme-stock-draftkings-nears-buy-signal/

4. “U.S. stocks extend losses after Walmart’s 2023 outlook disappoints By Investing.com” Investing.com, 21 Feb. 2023, https://www.investing.com/news/stock-market-news/us-stocks-were-falling-after-walmarts-2023-outlook-disappoints-3009222

5. “Dow drops by almost 650 points as retail earnings disappoint” WRAL News, 21 Feb. 2023, https://www.wral.com/dow-drops-more-than-550-points-as-retail-earnings-disappoint/20729757

6. “Dow Jones Tumbles Nearly 700 Points, S&P 500 Nears Key Support; Here’s What To Do Now | Investor’s Business Daily” Investor’s Business Daily, 21 Feb. 2023, https://www.investors.com/market-trend/stock-market-today/dow-jones-tumbles-sp-nears-key-support-nvidia-earnings/

7. “Week Ahead: Retail Earnings, Berkshire Hathaway, and Time to Buy Nvidia Stock?” Yahoo Life, 21 Feb. 2023, https://www.yahoo.com/lifestyle/week-ahead-retail-earnings-berkshire-184606722.html